ATM Withdrawal Rules: You must have withdrawn money from ATM many times, but just think, if there is no money in the account, can you withdraw money from ATM? You just have to keep this condition in mind that in such a situation, withdrawing money will cost you a little more. Yes, in such a condition, you can get a Personal Loan through ATM. A bank also provides the facility of taking loan from its ATM. Yes, its name is HDFC Bank. Let’s know how to get a loan from ATM.

Check pre-approved loan offer

First of all, you have to check whether you have a pre-approved loan offer or not. You can either check this on the bank’s app or see it in the message sent by the bank. For this, you can also call the bank’s customer care.

Go to the ATM, click on the loan option

If there is a pre-approved loan offer on your account, then first of all you have to go to the HDFC Bank ATM. There you have to click on the loan option in the machine.

Confirm all loan details

After clicking on the loan option, a screen will open in front of you, on which your loan amount, interest rate, EMI, loan period, everything will be written. After reading the information carefully, you have to click on Proceed.

Verify your personal information

On the next page, some personal information related to you will be visible. Your name, email ID, address and account number will be written there. You have to verify and confirm all the information there and proceed further.

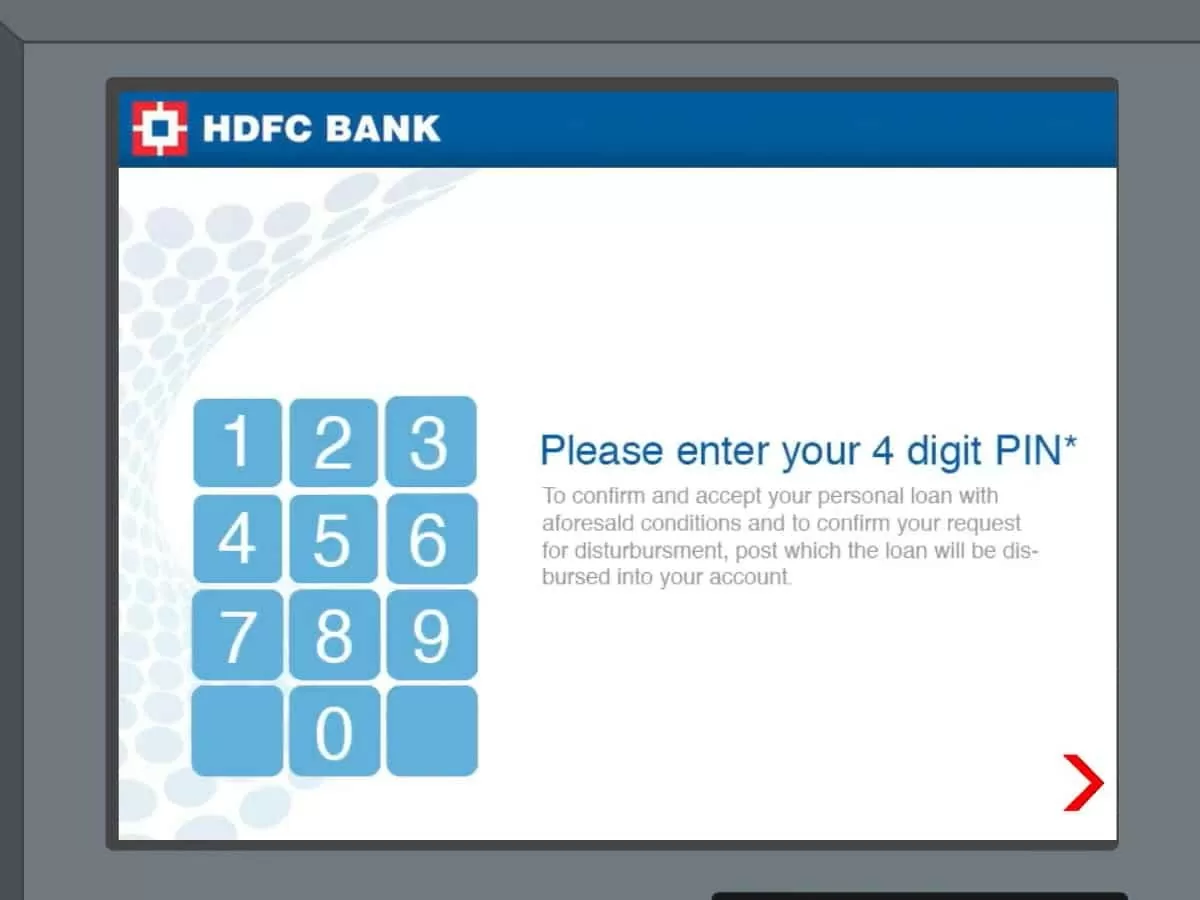

Enter your ATM PIN

The account will be transferred to your account in a jiffy

By doing this, the loan amount will be credited to your account, for which you will also see a message on the screen.

Withdraw cash from any ATM using your credit card

If you have a credit card, you can withdraw cash from any bank’s ATM. However, you should do this only when you are unable to get money in any other way. This is because if you withdraw money from a credit card, you will have to pay heavy interest from the very first day. The interest rate on a credit card can be up to 36-48 percent per annum.

Apart from withdrawing money, these 10 tasks are performed using an ATM

Whenever there is talk of ATM, the only picture that comes to mind is that money can be withdrawn from there. The main function of ATM is to provide cash to people without going to the bank. However, ATM is used for many other purposes, which very few people know about. Let us know what 10 things you can do along with withdrawing money from an ATM.

1- You can withdraw money

Everyone knows that money can be withdrawn from an ATM, which is its main function. For this, you must have your ATM card i.e. debit card and you must remember its PIN. You can withdraw money from your account by inserting the ATM card in the ATM.

2- Checking balance, viewing mini statement

Many people check their account balance through ATM. You can also go to ATM and check what transactions you have done in the last few days. You can see the last 10 transactions in the mini statement.

3- Transfer money from card to card

According to the website of State Bank of India, you can transfer money from one SBI debit card to another card. Up to 40 thousand rupees can be transferred through this every day. No charge is taken by the bank for this. For this, you should have your ATM card, you should know your PIN and also the card number of the person to whom you want to send money.

4- Credit card payment (VISA)

You can pay the balance of any VISA card through ATM. However, for this you must have your card with you and you must also remember its PIN.

5- Transfer money from one account to another

You can also transfer money from your account to another account through ATM. Up to 16 accounts can be linked to one ATM card. After this, you just have to reach the ATM with your card and you can transfer money with complete security without any worry.

6- Payment of life insurance premium

You can also pay your life insurance premium using ATM. Many insurance service providing companies like LIC, HDFC Life and SBI Life have tied up with banks. Under this, you can pay your life insurance premium through ATM with complete security. You just need to remember the policy number and have the ATM card with you.

7- Request for cheque book

If your cheque book is full, you do not need to go to the bank to get a new cheque book issued. For this, you can go to the ATM and request for a new cheque book from there. This cheque book will reach you directly at your registered address. If your address has changed, then enter the new address while requesting for a cheque book.

8- Bill payment

You can also pay any of your utility bills using ATM. However, you cannot pay every bill. You first have to check whether the company whose bill you want to pay has a tie-up with the bank or not. Before making the payment, you also have to register the biller by going to the bank’s website. Well, nowadays very few people use it, because bill payments are made through UPI.

9- Registration for mobile banking

Nowadays, many banks start internet banking and mobile banking as soon as you open an account. However, if your mobile banking is not active, you can activate it by going to the ATM. Even if you do not want to avail the mobile banking service already available, you can de-register it by going to the bank.

10- You can change the PIN

If you want to change the PIN of your ATM card, then you will get this facility at the ATM. Many times people change their PIN because someone else gets to know it. On the other hand, it is a good habit to keep changing your PIN at regular intervals, so that you can avoid the danger of cyber fraud.