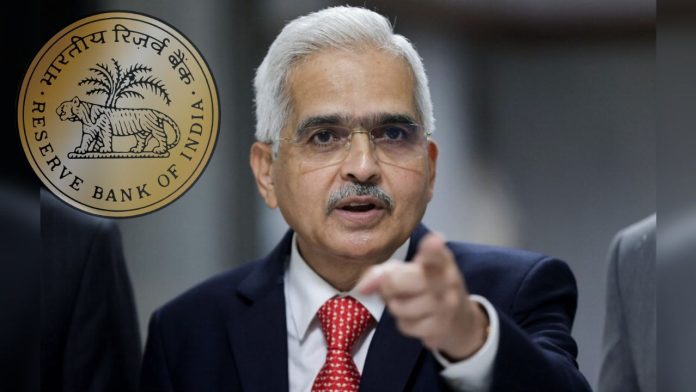

RBI has canceled the licenses of two banks. These banks will no longer be allowed to do banking business. Let us know what will happen to the customers’ money?

Bank License Cancelled: Reserve Bank of India (RBI) has canceled the licenses of two banks on the same day. Both the cooperative banks are located in different states of the country. RBI has also issued an order in this regard. The names of these banks are Sri Mahalakshmi Mercantile Co-operative Bank Limited (Dabhoi, Gujarat) and The Hiriyur Urban Co-operative Bank Limited (Hiriyur, Karnataka). Let us know why the Central Bank canceled the licenses of these banks?

This is the reason

The Hiriyur Urban Co-operative Bank Ltd and Sri Mahalaxmi Mercantile Co-operative Bank Ltd have been banned from conducting bank business with effect from January 12. Banks are not allowed to accept deposits and repay deposits. The RBI has also requested the Registrars of Co-operative Societies of both the states to issue an order to close the bank and appoint a liquidator for it. This step has been taken because these banks do not have sufficient capital and earning potential.

What did RBI say?

According to the statement of the Reserve Bank, the survival of the bank is harmful for the interests of the depositors. With its present financial condition the bank is unable to make full payments to the depositors. If these banks are allowed to continue banking business, it will affect public interest.

Customers can withdraw this much amount

Under Deposit Insurance and Credit Guarantee Corporation (DICGC) regulations, each depositor can avail deposit insurance claim amount of his/her deposits up to a monetary limit of Rs 5 lakh. According to statistics, more than 99% customers of both the banks are entitled to receive the full amount of their deposits.

Information given by the central bank

On the other hand, RBI has imposed a fine of Rs 2.49 crore on three banks including Dhanlaxmi Bank and Punjab and Sindh Bank for not following the rules. This information was given by the Central Bank. 1.20 on Dhanlaxmi Bank for not complying with certain instructions of ‘Loans and Advances – Statutory and Other Restrictions’, KYC and interest rate on deposits, RBI said. A fine of Rs crore has been imposed.

One crore fine on Punjab and Sindh Bank

RBI has imposed a fine of Rs 1 crore on Punjab & Sind Bank for not following the rules. The central bank has imposed a fine of Rs 29.55 lakh on ESAF Small Finance Bank for not following the instructions issued on ‘Customer Service in Banks’. Earlier, RBI has also imposed penalty on the largest public sector bank SBI, private sector giant HDFC and ICICI Bank in similar cases.

What will be the impact on customers?

The Reserve Bank has stopped the banking transactions of The Haripur Urban Co-operative Bank after the license was cancelled. This includes both depositing cash and withdrawing money. On behalf of the central bank, it was said that every account holder has the right to claim his deposits up to the monetary limit of Rs 5 lakh from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

According to the data given by the bank, 99.93 percent depositors are entitled to receive their entire money from DICGC. On the other hand, there will be no impact on the account holders of banks on which RBI has imposed penalty.