The RBI has directed banks to reduce debit card, late payment, and minimum balance charges to ease the burden on low-income customers. Reducing these fees will significantly benefit bank customers.

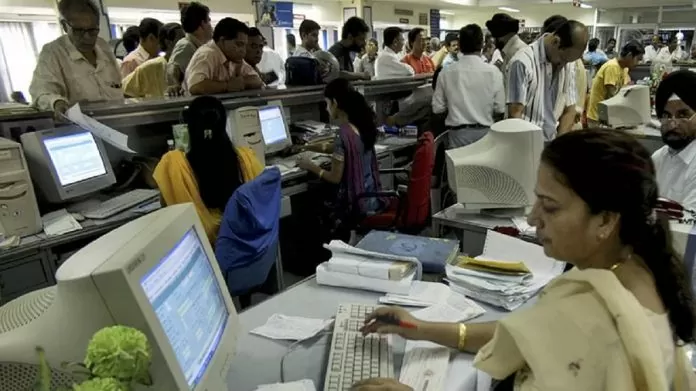

Bank System: The Reserve Bank of India (RBI) has asked banks to reduce charges levied on debit cards, late payments, and non-maintenance of minimum balance. The aim is to reduce unnecessary burden on ordinary customers, especially those with low incomes. However, the RBI has not set a specific limit for any fee, leaving it up to banks to decide when to reduce the fee. This step has been taken because banks have rapidly expanded their retail lending (such as personal loans, car loans, and small business loans). These new loans are increasing banks’ revenue, but the RBI wants to ensure that this increased revenue does not burden ordinary customers too much.

According to a Moneycontrol report, the RBI believes that high charges disproportionately affect poor and low-income customers. Although the central bank has not set any limit on the charges, private banks take advantage of this. Many banks charge processing fees of up to ₹25,000 on home loans. At the same time, fees ranging from 0.5% to 2.5% are being charged on retail and business loans.

What will the customer benefit from?

If banks heed the RBI’s advice and reduce fees, it will significantly benefit bank customers. Penalties for debit card and minimum balance violations will be reduced. Reducing late payment and other service fees will also save bank expenses.

Complaints are on the rise

Data from India Ratings and Research shows that banks’ fee income is again on the rise. It rose 12% to ₹51,060 crore in the June quarter. According to the RBI, complaints to the Ombudsman have increased at an average annual rate of 50% over two years, reaching 934,000 in 2023-24. The Ombudsman resolved 235,000 complaints in 2022-23. This number increased by 25% to 294,000 in 2023-24. In the 2023-24 financial year, 95 scheduled commercial banks received more than 10 million customer complaints.