DA Hike News: The Labor Bureau releases the Consumer Price Index for Industrial Workers (CPI-IW) every month. This index serves as the basis for determining DA under the 7th Pay Commission. The index for December 2025 was 148.2, the same as in November. However, since DA had reached 59.94% by November, it surpassed 60% (60.35%) with the December figures.

DA Hike News: Big news for central government employees and pensioners. With the release of the CPI-IW data for December 2025, the dearness allowance (DA) has been finalized, surpassing 60%. Although the formal announcement will be made in March 2026, the DA will be considered effective from January 1, 2026, and arrears will also be paid.

Why was the DA finalized?

Because the CPI-IW (2016 = 100) remained stable at 148.2 in December 2025, the DA, based on the 12-month average, exceeded 60%.

How was DA finalised?

Dearness allowance is calculated not by estimation but by a fixed formula. The Labor Bureau releases the Consumer Price Index for Industrial Workers (CPI-IW) every month. This index is the basis for determining DA under the 7th Pay Commission.

The index for December 2025 was 148.2, the same as in November. However, because DA had reached 59.94% by November, it crossed 60% (60.35%) as soon as the December figure was released.

The government always rounds off DA, so now 60% DA is considered fixed.

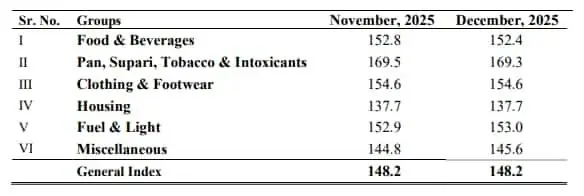

What do the CPI-IW figures for December 2025 say?

CPI-IW in December 2025:

- Remained stable at 148.2 points

- YoY inflation was 3.13%

- Inflation is lower than in December 2024 (when it was 3.53%)

This means that inflation did not rise sharply, but the average for the past 12 months became so high that DA crossed 60%.

How did DA reach 60%?

Look at the CPI-IW and DA trends over the past few months:

July 2025: CPI-IW 146.5 → DA 58.52%

August 2025: 147.1 → 58.94%

September 2025: 147.3 → 59.31%

October 2025: 147.7 → 59.60%

November 2025: 148.2 → 59.94%

December 2025: 148.2 → 60.35% (Effective)

This means that the 2% increase was confirmed as soon as the December figures were released.

| Month | CPI(IW)BY2001=100 | DA% Monthly Increase |

| July 2025 | 146.5 | 58.52 |

| Aug 2025 | 147.1 | 58.94 |

| Sep 2025 | 147.3 | 59.31 |

| Oct 2025 | 147.7 | 59.60 |

| Nov 2025 | 148.2 | 59.94 |

| Dec 2025 | 148.2 | 60.35 |

Announced in March, but implemented in January – why is this so?

This is standard government procedure for DA.

- DA is effective from January 1st and July 1st every year.

- But after the final CPI-IW figures (December/June) are released,

- the government brings a proposal to the Cabinet and announces it in March/September.

So:

- Effective date: January 1st, 2026

- Announcement: March 2026

- Benefit: January-February arrears

How much will this impact salary and pension?

Now, the most important question is how much will this impact your pocket.

If an employee has:

- Basic salary is ₹50,000

- 58% DA = ₹29,000

- 60% DA = ₹30,000

₹1,000 more per month

For pensioners:

- ₹30,000 basic pension

- DA hike could increase pay by ₹600-₹700 per month

This amount may seem small, but it has a significant net impact on millions of employees and pensioners.

5 Important Facts About DA

- DA is based on the CPI-IW.

- December 2025 CPI-IW is 148.2

- DA 60% Final

- Effective January 1, 2026

- Government Announcement in March 2026 + Arrears

Why is this DA special?

This isn’t just another DA increase.

Why is it important?

- 60% is a psychological level under the 7th Pay Commission.

- Last time, the HRA structure changed after crossing 50%.

- After 60%, discussions about a future pay reset intensify.

- This means that this DA increase is also linked to future salary policies.

What this means for you:

You are an employee > Salary and arrears will increase.

You are a pensioner > Monthly pension will increase.

You monitor HRA > Future changes are likely.

You are tracking the 8th Pay Commission > This will become the baseline data.

What could change next?

- Formal notification from the Cabinet in March

- Payment of DA arrears

- New CPI-IW race begins for July 2026 DA

- Discussions regarding the 8th Pay Commission intensify

What should you do now?

- Estimate your salary structure and arrears.

- Include the increased salary in your tax planning.

- Keep an eye on the CPI-IW trend for July 2026 DA.