Income tax: Despite the clear declaration of annual income of Rs 12 lakh being tax-free, many people are confused whether income up to Rs 12 lakh has really become tax-free? Actually, this confusion is because the government has made annual income up to Rs 12 lakh tax-free by giving tax rebate in the new tax regime. But the basic exemption limit has been kept at Rs 4 lakh only. Therefore, slab rates have been declared for income above Rs 4 lakh. Even more confusing is the fact that how much income tax will people have to pay whose income is a little more than Rs 12 lakh?

Rebate: Tax will be calculated, but you will not have to pay it

First of all, let us know what does it mean to declare tax slab for income above Rs 4 lakh despite income up to Rs 12 lakh being tax-free. Actually, this means that for people whose annual income is up to Rs 12 lakh, tax will be calculated according to the slab rate on their income above Rs 4 lakh, but on filing tax return, they will get the benefit of tax rebate up to Rs 60 thousand, due to which their actual tax liability will become zero. But if someone’s annual taxable income is more than Rs 12 lakh, then they will not get the benefit of tax rebate. That means they will have to pay tax according to the slab.

Tax liability on annual income of Rs 12.10 lakh

Now let’s know the answer to the second question. That is, if someone’s annual taxable income is Rs 12 lakh 10 thousand, then how much tax will he have to pay? Actually, for such people, tax liability will be calculated according to the slab on income above Rs 4 lakh, that is, on annual income of Rs 8 lakh 10 thousand. According to the slab rate, this tax will be calculated like this:

- 5% tax on income from Rs 4,00,001 to Rs 8 lakh (i.e. Rs 4 lakh) = Rs 20 thousand

- 10% tax on income from Rs 8,00,001 to Rs 12 lakh (i.e. Rs 4 lakh) = Rs 40 thousand

- 15% tax on income from Rs 12,00,001 to Rs 12 lakh 10 thousand (i.e. Rs 10 thousand) = Rs 1500

If we add the tax liability of these three tax slabs, then the total tax on income of Rs 12.10 lakh will be = Rs 61,500 (Rs 20,000+40,000+1500).

If you pay tax at slab rate, your income will be less than 12 lakhs

If you have to pay the entire tax added as per the slab in the above calculation, then a total tax of Rs 61,500 will be levied on an income of Rs 12 lakh 10 thousand. After paying this much tax, the take-home salary on an income of Rs 12.10 lakh will be reduced to Rs 11,48,500. That is, the take-home salary of a person earning Rs 12 lakh 10 thousand will be less than the person earning Rs 12 lakh. Whereas income up to Rs 12 lakh is tax-free. But will this really happen? Absolutely not. This is a confusion, the reason for which is incomplete information about the income tax rules. Actually, the Income Tax Department has made arrangements for marginal relief for such situations. Let us understand how this relief works.

Marginal relief will solve the problem

In the above example, the taxpayer will be given the benefit of marginal relief so that the income of the person earning Rs 12.10 lakh does not fall below the limit of tax-free income i.e. Rs 12 lakh after tax deduction. For this, in the above example, the taxpayer will have to pay tax of only Rs 10,000 and not Rs 61,500 on the income of Rs 12.10 lakh. The remaining liability of Rs 51,500 (Rs 61,500-10,000) will be waived as marginal relief. In this way, after paying tax, his income will remain Rs 12 lakh only. It will not be less than that.

What is the maximum limit of marginal relief?

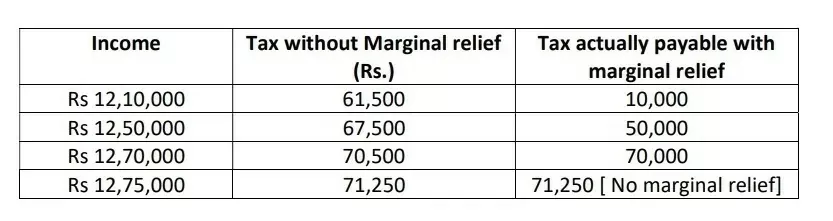

Actually, the benefit of marginal relief is available only to those who have a little more income than the tax-free income. Its amount is determined by the difference between the tax liability and tax-free income according to the taxpayer’s slab. The basic principle of this relief is that no one’s post-tax income should be less than the income declared tax-free. You can see the details of how much marginal relief will be available on income ranging from Rs 12 lakh to Rs 12.75 lakh in the table given below. It is clear from this table issued by the Income Tax Department as an example that marginal relief will be available only to those people whose annual taxable income is less than Rs 12 lakh 75 thousand.

What is the difference between tax rebate and marginal relief?

Income Tax Rebate means the exemption given on tax liability, which eliminates the tax liability calculated on annual income up to Rs 12 lakh. This rebate is being given under the new tax regime. Marginal Relief, on the other hand, is the relief given to those taxpayers whose annual income is slightly more than Rs 12 lakh. The purpose of this relief is to ensure that the income or salary after tax of such taxpayers is not less than Rs 12 lakh.