National Pension System: You can open a New Pension System (National Pension Scheme) account in the name of your wife. You have the option of depositing money every month or year as per your convenience. You can open an NPS account in your wife’s name with just Rs 1,000.

National Pension System: Everyone does future planning. Everyone also looks for a plan for their retirement. But, often people do not know the right tool. If you are worried about your retirement, then your wife can solve this problem. If you open this special account in the name of your wife, then the problem will be solved. National Pension System or National Pension Scheme (NPS) is one such scheme, in which not only you but also your wife can help you in making money. You can open a New Pension System (NPS) account in the name of your wife. The NPS account will give a lump sum amount to the wife at the age of 60. Apart from this, you will get the benefit of pension every month. This will be the regular income of the wife. The biggest benefit of NPS Account is that you can decide yourself how much pension you want every month. This will not cause tension about money at the age of 60.

Open NPS account in the name of wife

You can open a New Pension System (National Pension Scheme) account in the name of your wife. You get the option of depositing money every month or year as per your convenience. You can open an NPS account in your wife’s name with just Rs 1,000. The NPS account matures at the age of 60. Under the new rules, you can continue running the NPS account till your wife turns 65.

But, how will you make money from NPS?

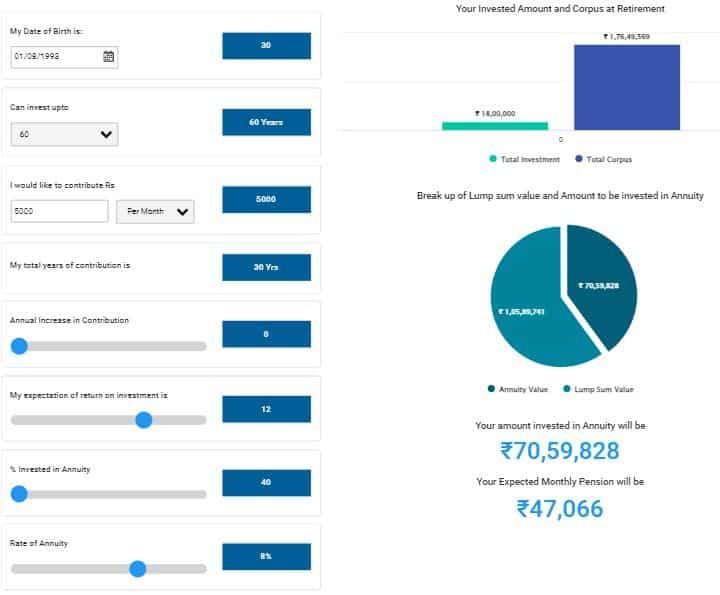

Suppose your wife is 30 years old now and you deposit Rs 5000 every month in NPS account. Your annual investment will be Rs 60,000. Continue investing for 30 years. Overall your investment will be Rs 18 lakh. But, money will be made now. At the time of retirement you will have a big fund of Rs 1,76,49,569. In this, Rs 1,05,89,741 will be received only from interest. Here we have kept the average interest at 12 percent. Now compounding works. The investment may be Rs 18 lakh but compounding took your money to more than two and a half crore rupees (Rs 1,76,49,569).

Now understand how the pension formula will be decided?

The biggest benefit of NPS Account is that you can decide how much pension you want. When your wife’s account matures at the age of 60, you will get Rs 1,05,89,741 in lump sum. This is the same money that has been earned from interest. Invest the remaining Rs 70,59,828 in annuity plan. We have kept the annuity at a minimum of 40 percent. The annual annuity rate is 8 percent.

A fund of Rs 1.76 crore will be created by investing Rs 5000 monthly

How much lump sum amount and how much pension will you get? We have done the calculation using HDFC Pension’s NPS calculator.

– Age- 30 years

– Total investment period- 30 years

– Monthly contribution- Rs 5,000

– Estimated return on investment- 12%

– Total pension fund- Rs 1,76,49,569 (on maturity)

– Annuity plan of Rs 70,59,828 (40%)

– Estimated annuity rate 8%

– Monthly pension- ₹47,066

The scheme is run by the Central Government

NPS is the Social Security Scheme of the Central Government. The money you invest in this scheme is managed by professional fund managers. The Central Government gives this responsibility to these professional fund managers. In such a situation, your investment in NPS is completely safe. However, the return on the money you invest under this scheme is not guaranteed. According to financial planners, NPS has given an average return of 10 to 12 percent annually since its inception.

(Note: Here the calculation of NPS has been done on a general basis. Your total fund will be decided by your investment and the returns you get. Do take the advice of a financial advisor before investing.)