RBI MPC Meet Updates: Repo rate is also known as prime interest rate. Repo rate is the rate at which commercial banks borrow money from RBI. When lending becomes expensive for banks, they also give loans to customers at higher rates. This simply means that loans like home loans, car loans and personal loans become expensive when the repo rate increases.

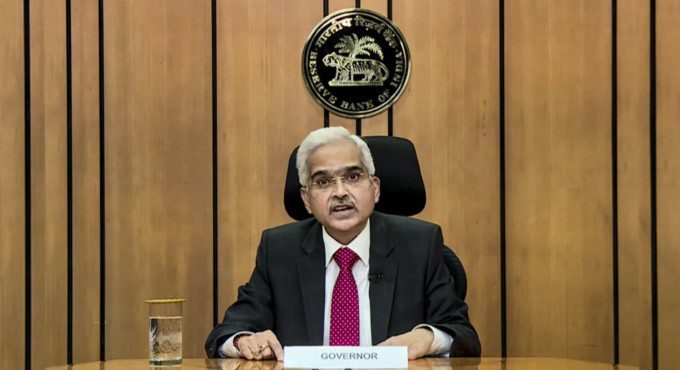

New Delhi: Interest rates on your loan and FD will increase or decrease in the coming times, it is going to be indicated today. Reserve Bank of India Governor Shaktikanta Das will brief the decisions of the Monetary Policy Committee on Friday. RBI’s MPC meeting began on August 3, which will conclude today. It is expected that this time also the RBI can increase the key interest rates. In the last policy announcement made on June 8, the RBI had increased the repo rate by half a percentage point. Due to this the repo rate had increased to 4.90 percent. Recently, the US central bank Federal Reserve (US Fed) also increased interest rates. In view of this, RBI is also likely to increase the repo rate.

What is Repo Rate?

Repo rate is also known as prime interest rate. Repo rate is the rate at which commercial banks borrow money from RBI. When lending becomes expensive for banks, they also give loans to customers at higher rates. This simply means that loans like home loans, car loans and personal loans become expensive when the repo rate increases. Apart from this, the interest paid to the customers on their deposits is also largely determined by the repo rate. That is, when there is an increase in the repo rate, banks increase the interest rates on FD.

Why does RBI increase the repo rate?

The Reserve Bank of India raises the key interest rates to control inflation. In this way RBI works to control demand by tightening monetary policy. There has been a marginal decline in inflation based on the Consumer Price Index after the RBI hiked the repo rate. Inflation in the US is currently at a 40-year high. To reduce this inflation, the Federal Reserve is increasing interest rates continuously. Significantly, when the corona virus epidemic came, central banks around the world had eased monetary policy and reduced rates significantly. RBI has already announced that it will gradually withdraw its liberal stance.

How much can your EMI increase?

If RBI hikes the repo rate by 50 basis points i.e. 0.50 per cent, then banks will pass on the burden to the customers. This will increase your loan installment. Along with the home loan, the installment of auto loan and personal loan will also increase. If your home loan is of Rs 30 lakh and the tenure is of 20 years, then your installment will increase from Rs 24,168 to Rs 25,093. Let us know that if the interest rate on the loan increases from 7.5 percent to 8 percent, what will be the difference on the EMI.

This rate hike is the fastest in a decade.

Home loan EMI payers should gear up to pay more. After the increase in the repo rate by the Reserve Bank of India, banks have started increasing the loan rates. According to a report in the Economic Times, this increase is the fastest in a decade.

Interest rates can reach 6 percent in a year

According to Adil Shetty, CEO of BankBazaar, it is expected that the repo rate will come down to 6 percent in the next 12 months. It is currently 4.90 per cent. It would be fair to assume that home loan borrowers will also see a similar hike in rates. Raj Khosla, managing director of financial marketplace MyMoneyMantra, said the rate hike has been the fastest in a decade. Till now the rates were very low because banks had enough cash. Now the rates are going to go back to their normalcy.

More amount to be paid in EMI

Recently, HDFC increased its benchmark retail prime lending rate (RPLR) by 0.25 per cent. Now the minimum loan rate has gone up to 7.80 per cent, which was 7.55 per cent earlier. If you have taken a loan of Rs 50 lakh for a tenure of 20 years, then an EMI of Rs 41,202 will have to be paid every month at the rate of 7.80 per cent, as against the earlier EMI of Rs 40,433 at the rate of 7.55 per cent. In April, the rate was 6.40 percent, so the EMI was Rs 36,985. At the same time, State Bank of India has increased its repo-linked benchmark rate by up to 0.90 percent in the current financial year.