The new income tax regime has significantly reduced taxes for the middle class, leaving them with more money for consumption, savings, and investment. Direct tax collections have grown 7 percent year-on-year so far in FY 2025-26.

New Income Tax Regime: The government is continuously working to make the new income tax regime more attractive than the old one. It has been simplified, eased to comply, and presented as the default option for taxpayers. The changes made in the Union Budget 2025 have made the new income tax regime even more attractive, especially for the middle class. One of the key objectives emphasized during the previous budget was “Personal Income Tax Reform, with a special focus on the middle class.” Previously, the government has periodically made progressive changes to the tax slabs in the new income tax regime to reduce the tax burden on the middle class.

According to CBDT data, direct tax collections have grown by 7 percent year-on-year in the financial year 2025-26, while non-corporate tax collections have increased by 8 percent. This reflects the increasing contribution of individual taxpayers.

A look at the tax slabs of the old and new income tax regimes.

How the New Income Tax System Differs from the Old

Higher Tax-Free Limit: Budget 2025 increased the rebate limit under Section 87A under the new income tax regime. This effectively leaves tax-free on annual taxable income up to ₹12 lakh (approximately ₹5 lakh). Under the old income tax regime, this limit remains at ₹5 lakh (approximately ₹5 lakh). Rebate means tax exemption up to a certain limit.

Standard Deduction: The standard deduction limit for salaried and pensioners in the new income tax regime is ₹75,000. This allows a taxpayer to make a total annual income of up to ₹12.75 lakh (approximately ₹12.75 lakh) tax-free. The standard deduction limit in the old income tax regime remains at only ₹50,000, allowing a total annual income of up to ₹5.50 lakh (approximately ₹5.50 lakh).

Simpler Slabs and Lower Rates: The new system has simpler tax slabs and lower tax rates compared to the old income tax regime. It also requires less paperwork for compliance.

Default Option: The new income tax regime has now become the default option for taxpayers. If the taxpayer does not choose between the old and new income tax regime, the new income tax regime will automatically apply.

Which Income Tax Regime is More Beneficial?

The question of which income tax regime is more beneficial depends entirely on the taxpayer’s individual situation. If a taxpayer has very few tax deductions or prefers a simple and document-free tax filing process, the new regime may be more beneficial. However, if someone has tax deductions that can significantly reduce their taxable income, the old income tax regime may be preferable. Under the old regime, taxpayers can avail of various deductions, such as Section 80C (investment), Section 80D (health insurance), HRA (house rent allowance) exemption, and home loan interest. Therefore, to make the right decision, it is important to compare your income and deductions under both income tax regimes.

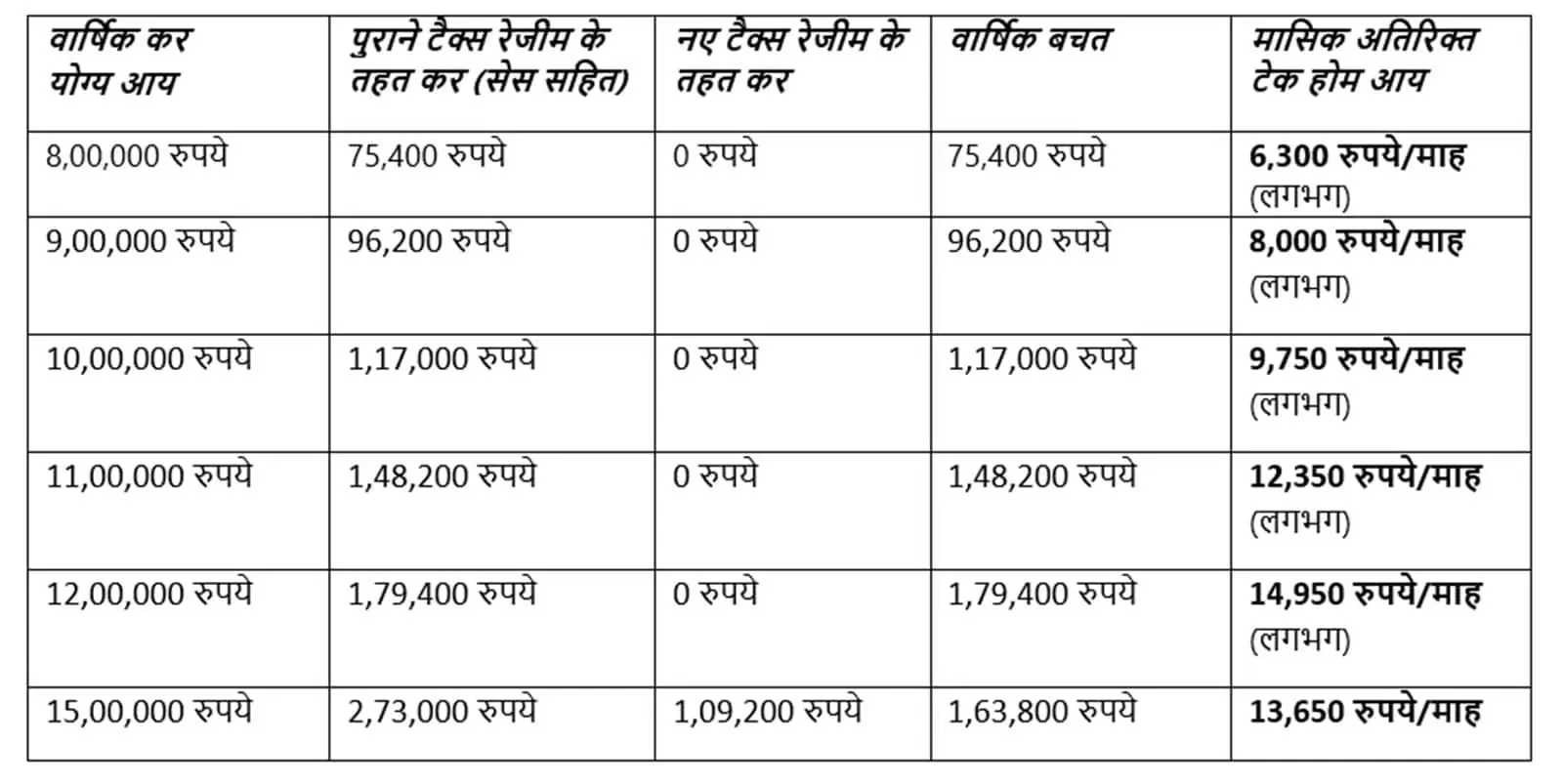

Let’s understand this with a simple example, considering different levels of taxable salaried income and assuming that the taxpayer is not availing of any tax deductions or exemptions.

(Figures have been rounded off. Actual figures may vary slightly due to rounding rules.)

This table shows that a person with an annual taxable income of up to ₹10 lakh would have to pay approximately ₹1.17 lakh in taxes under the old income tax system. However, adopting the new system could increase their monthly take-home salary by approximately ₹10,000, but only if they do not avail themselves of significant deductions.

Similarly, for an annual taxable income of ₹15,00,000, the tax liability under the new income tax system is ₹109,200. To reach the same level of tax liability under the old system, a taxpayer would need a total of approximately ₹537,500, including the standard deduction. If deductions are less than ₹537,500, the new income tax system will be more beneficial. However, if a taxpayer has deductions exceeding ₹537,500, the old system will be more beneficial.

The new income tax system has significantly reduced taxes for the middle class, leaving them with more money for consumption, savings, and investment. However, which system is beneficial depends on the individual’s financial situation and the deductions available to them.