ATM withdrawal charges: Banks offer only a specified number of free ATM transactions each month and this varies depending on the type of savings account chosen. When the prescribed limit is exceeded, banks levy a fee on any excess transaction, including financial and non-financial services. Free transactions and charges vary if the withdrawal is made from another bank’s ATM.

ATM withdrawal charges: In June of last year, the RBI granted banks permission to charge up to Rs. 21 per transaction at an ATM (Automated Teller Machine) in addition to the monthly free transaction cap, beginning on January 1, 2022. According to the RBI circular dated June 10, 2023, “Customers are eligible for five free transactions (inclusive of financial and non-financial transactions) every month from their own bank ATMs. They are also eligible for free transactions (inclusive of financial and non-financial transactions) from other bank ATMs viz. three transactions in metro centres and five transactions in non-metro centres. Beyond the free transactions, the ceiling / cap on customer charges is Rs 20 per transaction. To compensate the banks for the higher interchange fee and given the general escalation in costs, they are allowed to increase the customer charges to Rs 21 per transaction. This increase shall be effective from January 1, 2022.”

Here are latest ATM withdrawal charges of top banks like SBI, ICICI Bank, HDFC Bank and Punjab National Bank, as per the respective bank websites.

SBI ATM withdrawal charges

State Bank of India offers 5 free transactions (including financial and non-financial) at SBI ATMs for average monthly balances of up to Rs 25000 and above this amount, transaction is unlimited. Charges for financial transactions beyond the set limit is Rs 10 + GST at SBI ATMs and Rs 20 + GST at other bank ATMs.

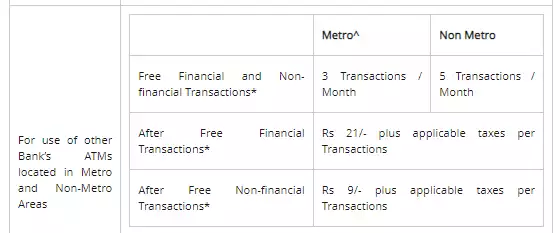

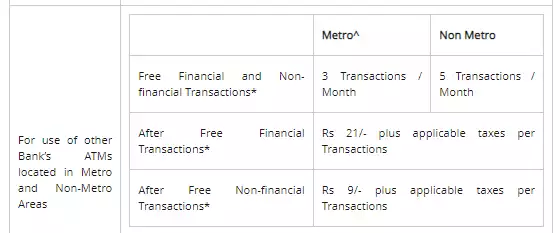

PNB ATM withdrawal charges

PNB provides 5 free transactions per month at PNB ATMs located in Metro and Non-Metro Areas. After the stipulated limit, each transaction will cost Rs 10/- + applicable taxes.

At other bank ATMS, PNB offers three free transactions in metro cities and five free transactions in non-metro cities. After that, the bank would charge Rs Rs 21/- plus applicable taxes for financial transactions and Rs 9 plus tax for non-financial transactions.

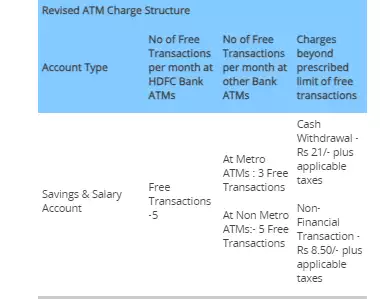

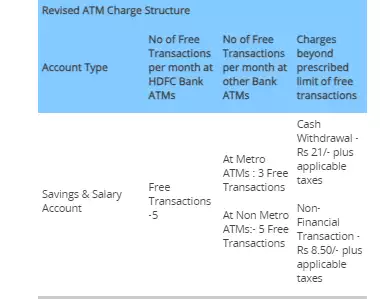

HDFC Bank ATM withdrawal charges

HDFC Bank provides 5 free transactions at its ATMs. At other banks bank offer three free transactions in metro locations, after which it charges Rs 21/- plus applicable taxes for cash withdrawals.

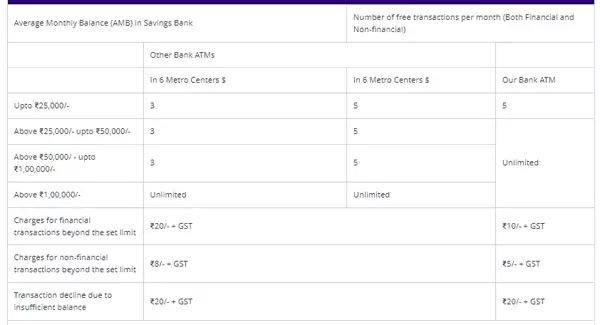

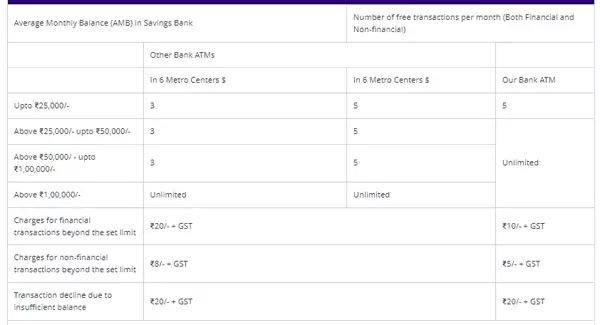

ICICI Bank ATM withdrawal charges

When it comes to free withdrawals, ICICI Bank follows the same 3- and 5-transaction rules as other banks. Thereafter, Rs.20 per financial transaction and Rs. 8.50 per non financial transaction.