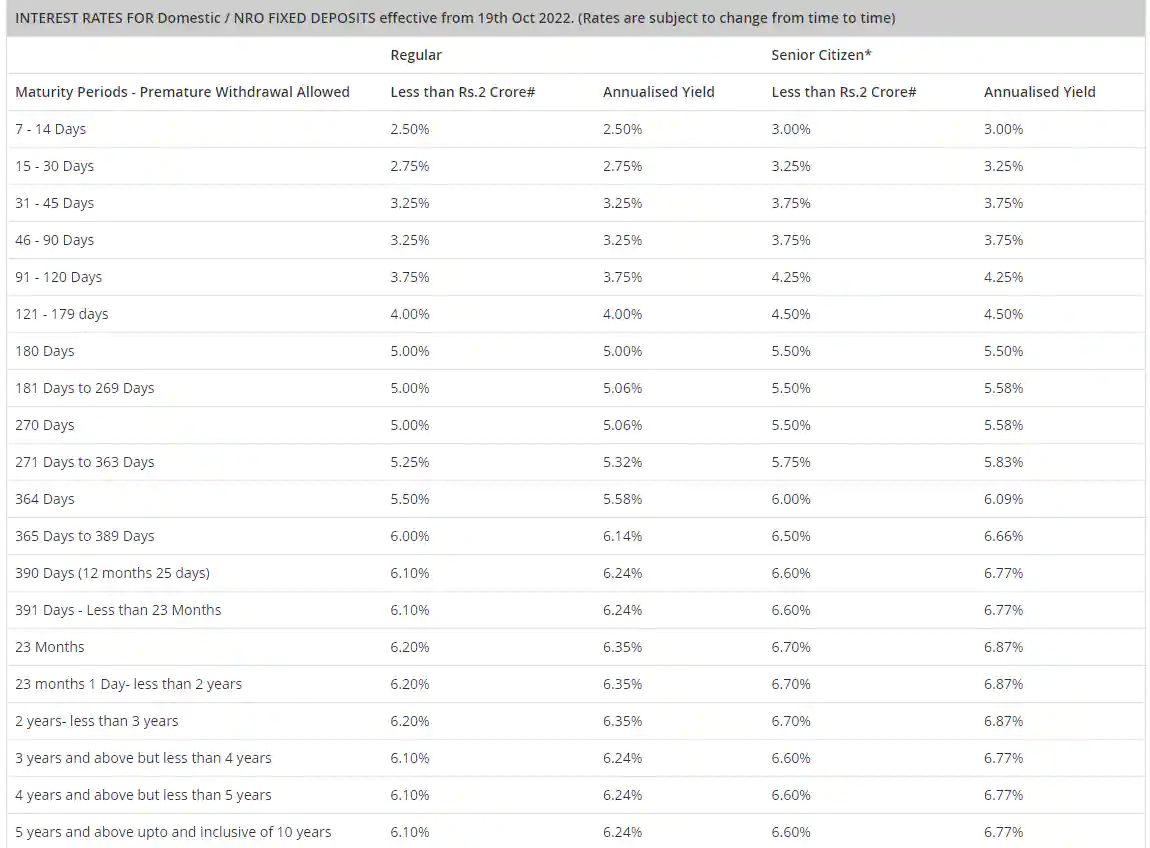

The private sector lender Kotak Mahindra Bank has hiked its interest rates on fixed deposits of less than ₹2 Cr. According to the bank’s official website, the new rates take effect on October 19, 2022. After the adjustment, the bank increased interest rates on certain tenors by as much as. Kotak Mahindra Bank is now giving an interest rate range of 2.50% to 6.10% for deposits maturing in 7 days to 10 years for the general public and 3.00% to 6.60% for senior citizens.

Kotak Mahindra Bank FD Rates

On deposits maturing in 7 – 14 Days, the bank will continue to offer an interest rate of 2.50% and on deposits maturing in 15 – 30 Days, Kotak Mahindra Bank has hiked the interest rate by 10 bps from 2.65% to 2.75%. Deposits maturing in 31 days to 90 Days will continue to offer an interest rate of 3.25% and deposits maturing in 91 – 120 Days will continue to fetch an interest rate of 3.75%. Kotak Mahindra Bank has hiked the interest rate by 25 bps from 3.75% to 4% on deposits maturing in 121 – 179 days and on deposits maturing in 180 Days to 270 Days the bank will continue to offer an interest rate of 5.00%.

The bank will continue to provide an interest rate of 5.25% on deposits maturing in 271 days to 363 days, and 5.50% on deposits maturing in 364 days. Deposits that mature in 365 days to 389 days and in 390 days (12 months 25 days) to less than 23 months will both continue to pay interest at a rate of 6.00% and 6.10%, respectively. On deposits maturing in 23 months to less than 3 years, Kotak Mahindra Bank will continue to give an interest rate of 6.20%, and on deposits maturing in 3 years and above up to and inclusive of 10 years, 6.10%.

In order to open a fixed deposit account, the depositor must deposit a minimum amount of Rs. 5,000, in consideration for the assurance of a specified interest rate, the amount is set for a predetermined period of time. For a fixed deposit, there are many ways to withdraw interest. You may pick from cumulative, monthly, or quarterly pay-out choices for the FD interest amount with Kotak Mahindra Bank. In order to provide better liquidity, the bank also permits depositors to withdraw funds from fixed deposits partially or prematurely.

Additionally, Kotak Mahindra Bank offers senior citizens an interest rate that is 50 basis points higher than the standard rate. The majority of banks have already announced interest rate hikes on fixed deposits in response to the repo rate hike. This week, interest rates on fixed deposits were hiked by banks like IndusInd Bank, ICICI Bank, DCB Bank, Union Bank of India, and Punjab National Bank. This is a magnificent surprise for those who are preparing their personal finances for the coming Diwali festival.

Read Also: LIC great policy – you will get the benefit of money back with guaranteed bonus, know details