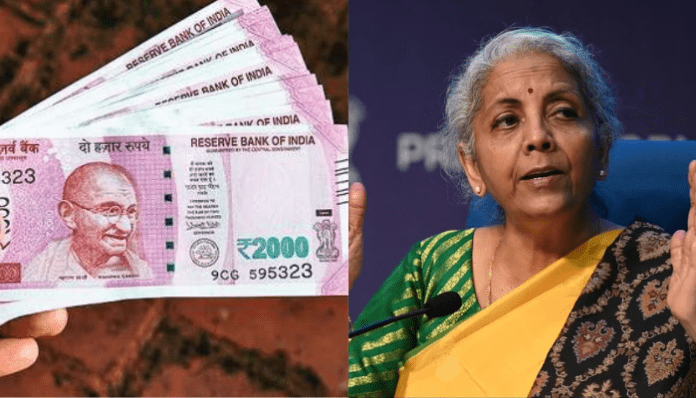

ITR Filing: In a statement issued by the Income Tax Department, it was said that in the financial year 2023-24, so far the direct tax collection has reached 26.05 percent of the total budget estimate. This includes income tax and company tax.

Tax Collection: So far during the financial year 2023-24, Net Direct Tax Collection has increased by 15.87 percent to Rs 4.75 lakh crore on an annual basis. According to the data released by the Ministry of Finance, the gross collection is Rs 5.17 lakh crore. This is 14.65 percent more than the gross collection of the same period last year. It is clear from this that the economic activities of the country have increased.

Reached 26.05 percent of the budget estimate

In a statement issued by the Income Tax Department, it was said that in the financial year 2023-24, so far the direct tax collection has reached 26.05 percent of the total budget estimate. This includes income tax and company tax. Direct tax collection after tax refund stood at Rs 4.75 lakh crore. This is 15.87 percent more than the net tax collection in the same period last year.

Issued ‘refunds’ worth Rs 42,000 crore

According to the ministry, during April 1 to July 9 this year, refunds worth Rs 42,000 crore have been issued. This is 2.55 percent more than the tax refund received in the same period last year. Gross direct tax collection increased by 14.65 percent to Rs 5.17 lakh crore. Net direct tax collection is estimated to be Rs 18.23 lakh crore in the budget for the financial year 2023-24. This is 9.75 percent more than Rs 16.61 crore for the financial year 2022-23.

The direct tax collection figures for the financial year 2022-23 show that the net collection was Rs 16.61 lakh crore. This is 17.63 percent more than the Rs 14.12 lakh crore of the previous financial year.