HDFC MCLR Hike: HDFC Bank has increased its MCLR i.e. Marginal Based Cost Lending Rate. MCLR has been increased by 0.05-0.15% on Wednesday from the bank. This hike has been done from overnight to 6 months MCLR.

HDFC Bank hikes MCLR: Private sector bank HDFC Bank has given a shock to the customers before the decision of the Monetary Policy Committee of the Reserve Bank on the policy interest rates. The bank has increased its MCLR ie Marginal Based Cost Lending Rate. MCLR has been increased by 0.05-0.15% on Wednesday from the bank. This hike has been done from overnight to 6 months MCLR. After this, the burden of loan installments on the customers has increased. These new interest rates have come into effect from today, June 7, 2023.

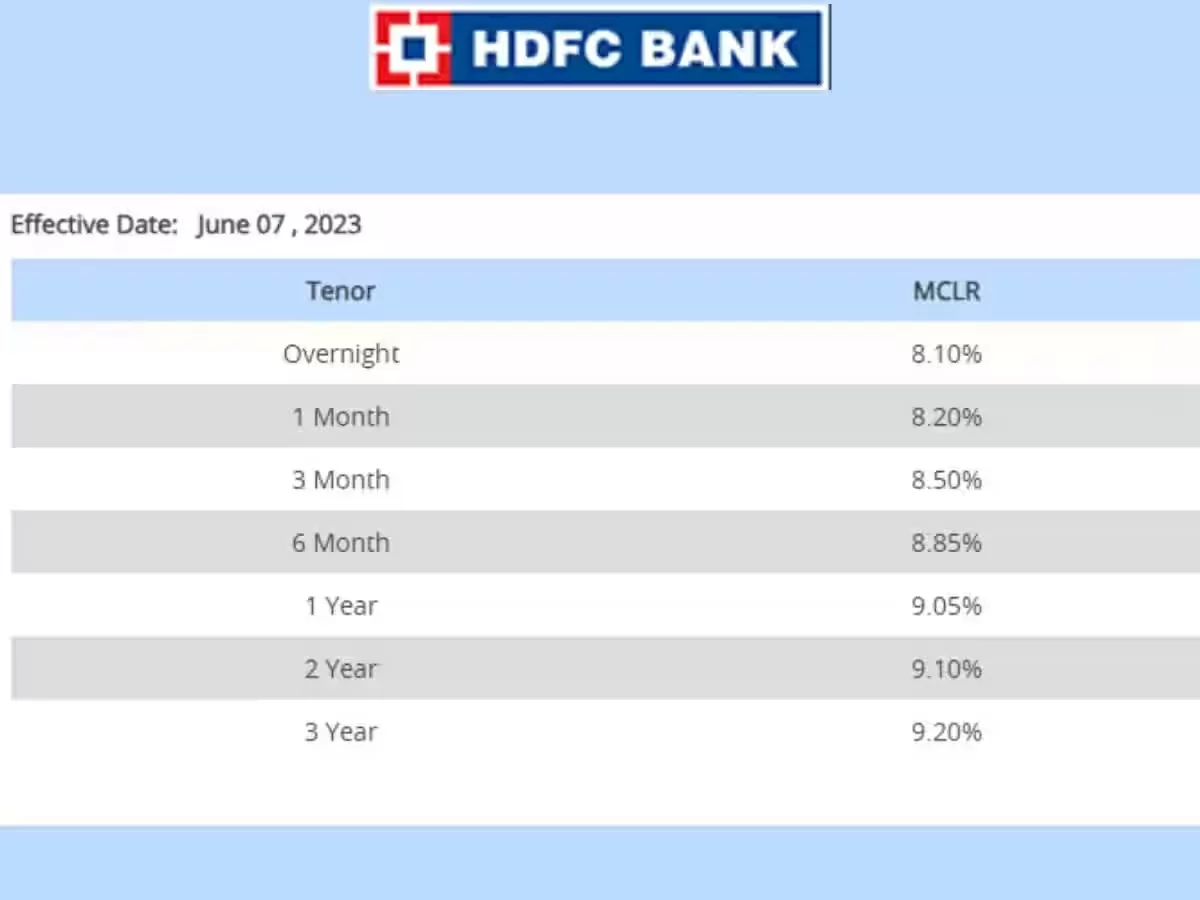

HDFC Bank MCLR Rates, June 2023

HDFC Bank has made overnight MCLR 8.10 percent, 8.20 percent for 1 month, 8.50 for 3 months and 8.85 percent for 6 months.

What is MCLR and what happens if it increases?

MCLR (Marginal Cost of Funds Based Lending Rate) is the minimum interest rate below which no bank can lend to customers. It is mandatory for banks to declare their overnight, one month, three months, six months, one year and two year MCLR every month. Increasing MCLR means that interest rates on loans related to marginal cost such as home loan, vehicle loan will increase. HDFC’s rate hike will make interest rates on EMI more expensive for new and old customers. This increase is applicable on floating interest rate and not on fixed interest rate. Also, after the increase in MACLR, the EMI will increase only on the reset date.