Old Pension Update: Tell that after the retirement of the government employee in OPS, half of the last basic salary and dearness allowance is given as pension from the treasury of the government. Dearness allowance is also increased twice every year, and the pension given to the family of the pensioner on the death of the pensioner is also included in the OPS.

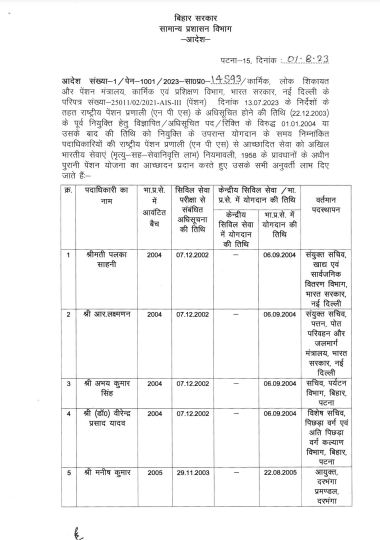

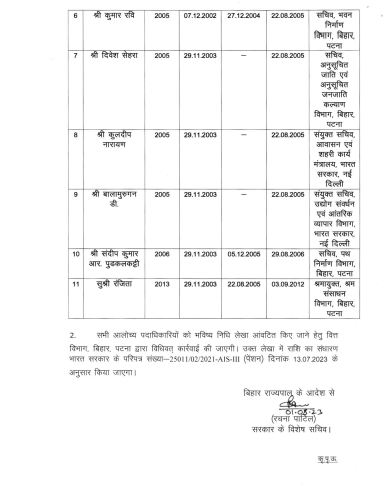

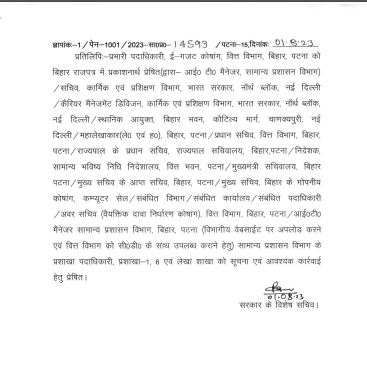

Old Pension News: There is good news for the Indian Administrative Service officers of Bihar. The state’s Nitish Kumar government has decided to give old pension to 11 IAS officers. The General Administration Department has also issued orders in this regard on Tuesday.

In fact, the new pension scheme has been implemented across the country since December 2003, before which the benefit of the old pension scheme was available. But the state government has decided to give the benefit of the old pension scheme to the servants appointed on the post notified for appointment before 2003. On July 13, the Government of India had sent a letter in this regard, in the light of which 11 IAS officers of Bihar cadre have been given the benefit of the old pension scheme.

These officers will get benefits

IAS Palaka Sahni, R Laxmanan, Abhay Kumar Singh, Dr. Virendra Prasad Yadav, Manish Kumar, Kumar Ravi, Divesh Sehra, Kuldeep Narayan, Bala Murugan D, Sandeep Kumar R. Pudkalkatti and Ms. Ranjitha will get the benefit of old pension.

Know what is the difference between OPS and NPS

- After the retirement of the government employee in OPS, half of the last basic salary and dearness allowance is given as pension from the treasury of the government. Dearness allowance is also increased twice every year, and the pension given to the family of the pensioner on the death of the pensioner is also included in the OPS.

- NPS is a contributory scheme, in which employees have to contribute ten percent of their salary. The government contributes 14% to the employee’s NPS account. Under the new pension scheme, a government employee has to contribute 10% of his basic salary to his pension, with the state government contributing only 14%.

- Retired employees also get the benefit of pension revision when the Pension Commission is implemented.

- Employees in OPS get gratuity of up to Rs 20 lakh after retirement. Dearness Allowance (DA) is applicable for employees in OPS after 6 months. Under the new pension scheme, 40% of the NPS fund has to be invested to get pension on retirement. Fixed pension is not guaranteed after retirement.

- NPS is based on the stock market. This does not include the provision of dearness allowance. In NPS, there is a provision to give 50 percent of the total salary as pension to the family members of the employee in case of death during service.

- Unlike OPS, in the new pension scheme, whatever money you get on retirement according to the stock market, you have to pay tax on it.

- On the retirement of the employee in OPS, he does not have to pay any income tax on the interest of GPF. There is no permanent provision of gratuity at the time of retirement in NPS. Dearness Allowance (DA) received after 6 months in New Pension Scheme (NPS) ) do not apply.