On fixed deposits under ₹2 crore, the public sector lender Punjab National Bank (PNB) raised the interest rates. According to the bank’s official website, the new rates are in effect as of today, October 19, 2022. Following the adjustment, PNB increased interest rates on fixed deposits across a range of tenors by up to 50 bps. According to the new interest rates, the general public’s maximum interest rate is now 6.50%, while senior citizens’ maximum interest rates are now 7%, and super senior citizens’ maximum interest rates are now 7.30%.

PNB FD Rates

On fixed deposits maturing in 7 days to 45 days, the bank has hiked the interest rate by 50 bps from 3% to 3.50% and on deposits maturing in 46 to 90 days, PNB has hiked the interest rate by 50 bps from 3.25% to 3.75%. Deposits maturing in 91 days to 179 days will now offer an interest rate of 4.50% which was earlier 4% a hike of 50 bps and term deposits maturing in 180 days to 1 year will now offer an interest rate of 5% which was earlier 4.50% a hike of 50 bps. PNB has hiked the interest rate by 20 bps from 5.50% to 5.70% on deposits maturing in 1 year to 404 days but the bank will continue to provide an interest rate of 6.10% on deposits maturing in 405 days.

PNB increased interest rates on deposits maturing in 406 days to 599 days by 20 basis points, from 5.50% to 5.70%, and will now provide a maximum interest rate of 6.50% on deposits maturing in 600 days. Deposits with maturities between 601 days and two years will now provide an interest rate of 5.70 per cent, up from 5.5 per cent previously and a 20-bps increase, while deposits with maturities between two and three years will now offer an interest rate of 5.80 per cent, up from 5.6 per cent. PNB has hiked interest rate by 5 bps from 5.75% to 5.80% on deposits maturing in 3 to 5 years and also a hike of 20 bps from 5.65% to 5.85% can be seen on deposits maturing in 5 to 10 years.

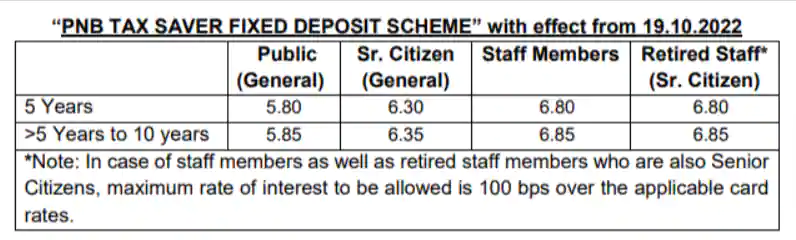

PNB Tax Saver FD

On tax-saver deposits maturing in 5 years, PNB will now offer an interest rate of 5.80% to the general public, 6.30% to senior citizens, and 6.80% to staff members and retired staff senior citizens. Whereas tax saver deposits maturing in more than 5 years to 10 years, the bank will now offer an interest rate of 5.85% to the general public, 6.35% to senior citizens and 6.85% to staff members and retired staff senior citizens.

On domestic deposits of less than Rs. 2 crores, senior citizens who are 60 years of age and over (up to 80 years of age) would get an additional rate of interest of 50 basis points (bps) over the standard rates for a term up to 5 years and 80 bps for a period above 5 years. The maximum rate of interest that can be applied over the applicable card rate for existing employees and retired staff senior citizens shall be 150 bps for a period up to 5 years and 180 bps for a period above 5 years. Additionally, super senior citizens who are over 80 years old will get an additional rate of interest that is 80 basis points higher than the standard rate for all maturity tenors.

The maximum rate of interest that can be levied above the relevant card rate for employees and retired staff senior citizens is 180 bps over and above the standard rate for all maturity tenors. The maximum rate of interest over and above the standard rate for PNB Tax Saver Fixed Deposit Scheme for staff members and retired staff senior citizens is 100 bps.

Read Also: IndiGo launches Diwali special sale: Festive Vibes Offer! Flight Fares Start from Rs 1,499 Only, check details