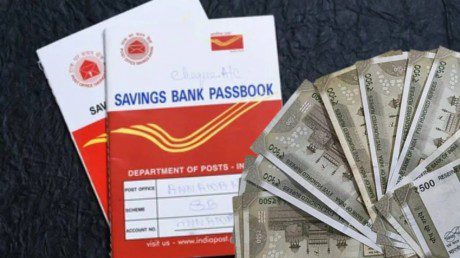

Post Office Interest Rate: If you are looking for investment options then this information will be very beneficial for you. Various post office schemes are seen as good investment options. There are many post office schemes in which you can invest. Today in this article we will learn about one such scheme. If you are willing to invest a large amount every month then this plan can be very beneficial for you.

Post Office Monthly Income Scheme is becoming a popular option for savings and investment. Under this scheme, investors get guaranteed monthly income. Investors who want to deposit large amount can earn huge returns by depositing Rs 5000 every month. In this article, let us understand how much time it takes to deposit Rs 8 lakh in the Post Office Monthly Income Scheme by depositing Rs 5000 every month.

What is monthly income plan?

Post Office Monthly Income Scheme is a low-risk investment scheme launched by the Indian Postal Service. Those investing in this plan get a fixed amount every month. This makes it an attractive option for those looking for stable returns. The maturity period of this scheme is 5 years. This makes it a good option for both short-term and long-term investors.

In how many days do you get Rs 8 lakh?

To calculate the time taken to receive more than Rs 8 lakh in the Post Office Monthly Income Scheme, you need to consider the following factors. In this plan, monthly deposit can be made up to Rs 5000 and the maturity period of the plan is 5 years. You can calculate the total deposit and interest received in 5 years using the two formulas given below.

* Total Deposit = Monthly Deposit × Number of Months

* Interest Earned = Total Deposit × Interest Rate

Post Office Monthly Income Scheme interest rates vary and may vary. According to an update in September 2021, the interest rate stood at around 6.6%. Check the current interest rates offered by the post office to know the exact amount. Importantly, Post Office Monthly Income Plans are a reliable way to accumulate savings over time. By depositing Rs 5000 per month and availing the interest rate of the scheme, investors can deposit more than Rs 8 lakh within the given time period. It is important to consult the post office or a financial advisor for accurate information about interest rates and investment strategies.

Disclaimer: Investing in mutual funds and stock market is based on risk. Before investing in the stock market, definitely consult your financial advisor. hindi.Maharashtranama.com will not be responsible for any financial loss.