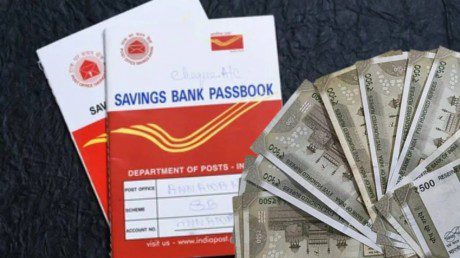

Post Office Interest Rate: Everyone saves a part of their earnings and plans to invest the money in a place which will not only raise huge amount of money in future but also arrange regular income after retirement. Post Office Savings Scheme is very popular in this regard. By investing in the Post Office Monthly Income Plan included in this, you can earn a regular income of Rs 9,000 every month. Let us know more about it.

In terms of safe investments, post office savings schemes are very popular in India. These schemes are available for all age groups, i.e. from children to the elderly, these schemes can be availed. In terms of interest, this scheme is no less than other schemes.

Today we will learn about this Post Office Monthly Income Scheme. This is a great plan. After investing in this scheme, you will get a fixed income every month, and since it is a government scheme, your money will also be completely safe.

In this scheme of post office, not only the money remains safe but the interest is also higher as compared to banks. If you want to invest for five years then this can be a profitable investment. In Post Office Monthly Savings Scheme, you can invest a minimum of Rs 1,000 and a maximum of Rs 9 lakh in an account.

If you open a joint account, the maximum investment limit has been fixed at Rs 15 lakh. This means that both husband and wife can invest up to Rs 15 lakh in a joint account. A maximum of three people can invest in a joint account.

If you want to arrange monthly income after retirement or before retirement, then you can start investing in this plan of the post office. The government is currently offering an annual interest rate of 7.4% on this savings scheme. Under this scheme, this annual interest on investment is distributed in 12 months and after that you keep getting this amount every month. If you do not withdraw the money monthly, it will remain in your post office savings account and you will get more interest by adding this money to the principal amount.

Now if you want a regular income of more than Rs 9,000 per month, you will have to open a joint account. Suppose you invest Rs 15 lakh in it, then your annual interest rate of 7.4% will be Rs 1.11 lakh.

If this interest amount is divided equally in 12 months of the year, then you will get Rs 9,250 every month. If you open a single account, then on a maximum investment of Rs 9 lakh, you will get Rs 66,600 as interest annually, i.e. Rs 5,550 every month.

Where can this account be opened?

Like other savings schemes of Post Office, it is very easy to open an account in Post Office Monthly Income Scheme. You can open this account by going to your nearest post office. For this, you will have to fill only one form and to open the account from the filled form, you will have to deposit the prescribed amount in cash or cheque. To open an account in this scheme, it is mandatory to have PAN card and Aadhar card.

Disclaimer: Investing in mutual funds and stock market is based on risk. Before investing in the stock market, definitely consult your financial advisor.