Post Office MIS Account: You can get interest up to 7.4% by opening an account under the Post Office MIS Scheme. TDS is not deducted on the interest received. But the benefit of 80C is not available.

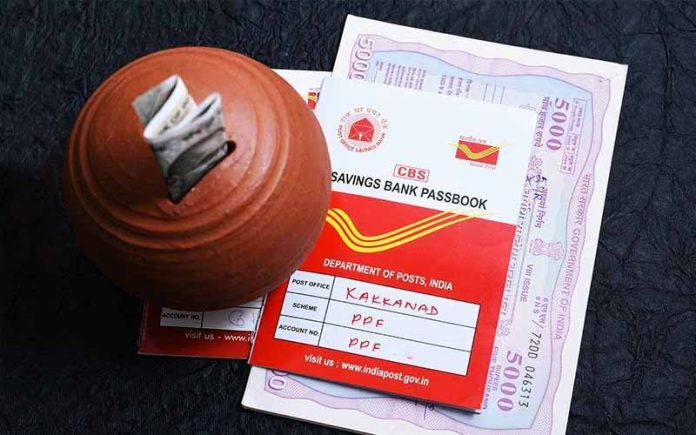

Post Office MIS Account: At a time when savings bank accounts are offering interest rates of 2.75% to 3.50% per annum, there are also some sovereign supported depository schemes which offer more than 7% interest on deposits. Post Office Monthly Income Scheme (POMIS) is one of them.

Post Office Monthly Income Scheme (POMIS) is one of the highest earning, low risk and fixed income schemes offering an interest rate of 7.4% per annum. In this scheme, the investor can deposit every month and interest on this scheme is paid every month. The special thing about this scheme is that no TDS is deducted on the interest received.

This scheme – like other post office schemes – is recognized and recognized by the Ministry of Finance. The sovereign guarantee makes Post Office MIS Account a safe investment option compared to equity shares and many fixed income options.

Features and Benefits of Post Office Monthly Income Scheme

Capital Security and Low Risk Investment: Being a sovereign guarantee scheme, your capital remains safe till maturity and the investment is not subject to market risks.

Affordable Deposit Amount: As per your capacity, you can open a Post Office MIS account with a nominal investment of Rs 1,000 and in multiples of Rs 1,000. The maximum investment limit in a single account in Post Office MIS account is Rs 9 lakh, for joint accounts the maximum deposit limit has been increased to Rs 15 lakh.

Maturity Period: Maximum lock-in period for Post Office MIS Account is 5 years. After the scheme matures, the investor can withdraw the invested amount or reinvest the corpus.

Premature Withdrawal: As per the scheme norms, the investor cannot withdraw the deposit amount before the expiry of 1 year from the date of deposit. If the investor withdraws the investment amount before the end of the lock-in period, a penalty is imposed. If the account is closed before three years from the date of account opening, 2% amount is deducted from the principal amount and if closed before 5 years, 1% amount is deducted from the principal amount.

Tax-Efficiency: TDS is not applicable on interest received every month. This investment is not covered under section 80C.

Guaranteed Returns: Interest is paid every month and returns do not have to beat inflation.

Transferability: You can transfer your POMIS account to any other post office anywhere in India if you change your place of residence

Nomination Facility: As per the scheme norms, the investor can nominate a beneficiary so that he can claim the benefits and funds after his demise. It is important to note that a nominee can be appointed even after the account is opened.

Eligibility for Post Office Monthly Income Scheme

- To open a POMIS account, the investor must be a resident Indian.

- Non-Resident Indians (NRIS) are not eligible to open Post Office MIS account.

- A resident Indian can also open a POMIS account on behalf of a minor child aged 10 years and above.

- Only the child can avail the benefit of the fund after completing the age of 18 years.

Documents required for Post Office Monthly Income Scheme

The following documents are required to open a post office MIS account:

Identity Proof: A copy of any ID issued by the government like passport or voter ID card or driving license or Aadhaar number etc.

Address Proof: Government issued ID containing the investor’s residential address or recent utility bill.

Photo: Passport size photo

Step-by-Step Guide to Open Post Office Monthly Income Scheme Account

- You must have a post office savings account, if not then open it.

- Get an application form from your nearest post office.

- An investor can download the Post Office MIS Account Application Form from the following link: https://www.indiapost.gov.in/VAS/DOP_PDFFiles/form/Accountopening.pdf

The investor will have to fill the form and submit it to the nearest post office along with self-attested copies of all the above required documents. - Keep the original documents with you as they will be required at the time of verification.

- Provide name, date of birth and mobile number of nominated persons (if any)

- Do not forget to carry at least Rs 1000 in cash or a check of the same amount. As per the norms of the scheme, an investor will have to deposit a minimum initial amount of Rs 1000 through cash or check to open a POMIS account.