RBI Big Order on Property Documents: This instruction of RBI will be applicable to such loan accounts including personal loan, home loan, car loan, for which the borrower has mortgaged his movable and immovable property.

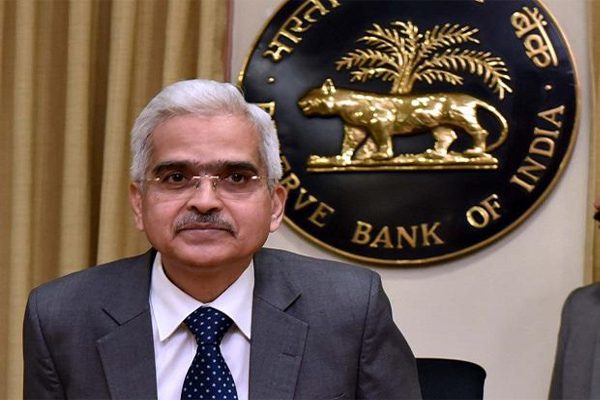

RBI Big Order on Property Documents: Reserve Bank (RBI) has taken the initiative to provide a big relief to home loan buyers. In this, RBI has clearly ordered the bank or NBFC to return the property documents within 30 days of repayment. If you do not do this, a fine of Rs 5,000 will have to be paid every day. The Reserve Bank has also said that if any charge has been lodged with any registry, it will also have to be removed. This instruction will be applicable to such loan accounts including personal loan, home loan, car loan or gold loan, for which the borrower has mortgaged his movable and immovable property.

The new rule will come into effect from December 1, 2023

According to the notification issued by the Reserve Bank, the new rule will come into effect from December 1, 2023. The order said that if there is a delay in issuing the documents by the bank or REs, a fine of Rs 5,000 will be imposed per day. The fine amount will have to be paid by the concerned property owner.

RBI said that if any lender’s property papers are lost, then the bank will have to help the customer in obtaining a duplicate copy of the papers. Let us tell you that after repayment of the loan, it is necessary to return the documents of movable and immovable property to the bank. RBI has sent instructions to all banks and Regulated Entities (REs) on 13 September.

To address the issues faced by the borrowers and towards promoting responsible lending conduct among the Regulated Entities, RBI issues directions — The Regulated Entities shall release all the original movable/immovable property documents and remove charges registered with any… pic.twitter.com/ZPc8xCn49n

— ANI (@ANI) September 13, 2023

The Reserve Bank says that even after repaying the loan, the property papers of the customers are not being received on time. Complaints regarding this are increasing between customers and the bank. Therefore the Reserve Bank had to issue instructions. The Reserve Bank has said that when the full repayment of the loan has been made, the banks or financial institutions will have to return all the documents within 30 days. Also, if any charge has been lodged with any registry, it will also have to be removed.