RBI New Rules on Loan: The central bank has prohibited the imposition of penalty on the loan account. Along with this, RBI has told that the new rule will be implemented from next year. This new rule of RBI will apply to all banks.

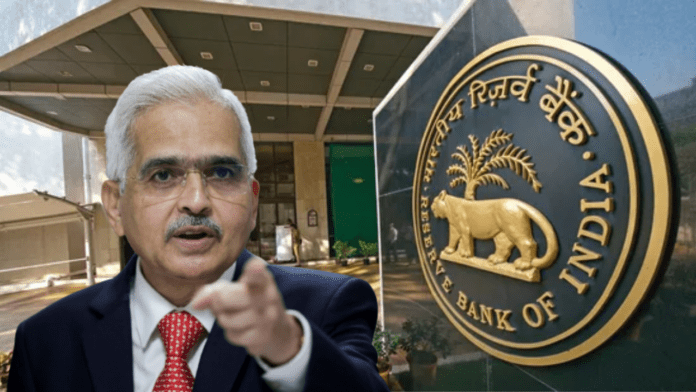

Reserve Bank of India: Reserve Bank of India (RBI New Rules) has given great relief to crores of people. RBI has changed the rules regarding penalty and interest rates in loan accounts. The central bank has prohibited the imposition of penalty on the loan account. Along with this, RBI has told that the new rules will be implemented from next year. This new rule of RBI will apply to all banks. New rules will apply to all banks like Commercial, NBFC, Cooperative Bank, Housing Finance Company, NABARD, SIDBI.

RBI issued rules

The Reserve Bank of India (RBI) has expressed concern over the tendency by banks and non-banking financial companies (NBFCs) to use ‘penal interest’ as a means of increasing their revenue. The central bank has issued revised rules in this regard. Under the new rules, in case of default in loan payment, now banks will be able to levy only ‘reasonable’ penal charges on the concerned customer.

New rules will be applicable from January 1, 2024

In a notification issued on Friday regarding ‘Fair Lending Practices – Penal Fees on Loan Accounts’, the Reserve Bank said that banks and other lending institutions will not be required to levy penal interest from January 1, 2024. Will not be allowed.

Central bank said this

In the notification of the central bank, it has been said that if the borrower does not comply with the terms of the loan agreement, he can be charged a ‘penal fee’. This will not be charged as penal interest. Banks add penal interest to the interest rates charged on advances. Along with this, the Reserve Bank has clarified that the penal fee should be reasonable. It should not be biased towards any loan or product category.

Additional interest will not be calculated

The notification states that there will be no capitalization of penal charges. No additional interest will be calculated on such charges. However, these instructions of the central bank will not apply to credit cards, external commercial loans, trade credits etc. The central bank has said that the intention of imposing penal interest/fee is to inculcate a sense of discipline in the borrower regarding the loan. It should not be used by banks as a medium to increase their revenue.