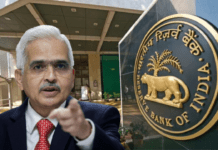

RBI Update: AGM of Reserve Bank of India (RBI) has made a big announcement.

Assistant General Manager B Mahesh has said that old notes of 5, 10 and 100 rupees can be withdrawn in March or April, although this plan is under consideration but it can be announced soon. is.

Also Read: Alert! NPCI also released Alert for UPI users, do not pay at this time or else …

RBI Latest News: A statement by RBI (RBI) Assistant General Manager B Mahesh (B Mahesh) reminded of demonetization. B Mahesh has said that the Reserve Bank is considering a plan to withdraw old notes of 5, 10 and 100 rupees. If everything goes well, it can be announced in March and April.

100 rupee note will be closed

From time to time, the Reserve Bank closes the old series of notes to avoid the risk of fake notes. All the old notes which have been closed after the authorized declaration have to be deposited in the bank. The value of the total notes deposited is deposited in the bank account or gives a new note.

The old 100 rupee note will also continue

2 years ago the RBI (RBI) issued a new note of 100. The new note of 100 rupees is of deep violet color and has been given place to the historical site Rani ki Vav. It is also called Rani ki Bawdi. Rani ki Vav is located in Patan district of Gujarat (Gujrat).

Also Read: How To Identify A Fake Bank Message/SMS?

UNESCO_ UNESCO_ included 2014 Rani ki Vav in World Heritage According to the UNESCO website, the queen’s wav is connected to the Saraswati river. UNESCO has given it the title of queen of steps. B Mahesh said that despite the issue of new notes, the old 100 rupee notes It will also continue to be considered as a valid currency.

10 rupee coins become headache for RBI

Coins of 10 rupees have become a headache for the Reserve Bank. The 10 rupee coin was brought 15 years ago, but the shopkeepers and businessmen are still refusing to take it. Rumor is spread about its validity. Due to this, a mountain of 10 rupee coins has become standing with the Reserve Bank. On this, RBI Assistant General Manager B Mahesh has said that all banks should make people aware about the 10 rupee coin that there is no plan to close this coin nor any of the fake coins. There is danger The bank should make every effort to ensure that the coin of 10 rupees continues in the market as before.

Latest News on RBI

RBI ban on Co-operative Bank: RBI has now banned another bank. If you also have an account in this bank then you will not...

Bank Holidays May 2024: Only a few days are left for the month of May. According to the list of holidays released by the...

The Reserve Bank of India (RBI) has imposed penalty on Rajkot Citizens Co-operative Bank, Kangra Co-operative Bank (New Delhi), Rajdhani Nagar Co-operative Bank (Lucknow),...

Now banks will not be able to hide information about various charges and fees on loans from customers. They will have to inform customers...

Sarvodaya Co-operative Bank: The Reserve Bank of India (RBI) on Monday imposed several restrictions on Mumbai-based Sarvodaya Co-operative Bank in view of its deteriorating...

The Reserve Bank of India (RBI) has informed on April 8 that it has imposed monetary penalty on five co-operative banks for violating the...

The Reserve Bank of India (RBI) has imposed a fine of Rs 1 crore on IDFC First Bank and Rs 49.70 lakh on LIC...

Now in the coming time, it is going to be easier for the common man to invest in government securities. For this, preparations are...

All 10 banks are co-operative banks. RBI had issued a statement on March 26 and 27 regarding the imposition of penalty on these banks....

2,000 Rupees Note: RBI said that about 97.69 percent of Rs 2,000 notes have returned to the banking system, while such notes worth Rs...

Paytm FASTag Recharge: After the action of RBI on Paytm Payments Bank, it has become difficult for Paytm users. On the other hand, NHAI...

Credit Card New Rule: After the rules are issued by RBI, customers can change the billing cycle/period of the credit card more than once...

Cash Deposit Limit: Most of the people in the country have a bank account. Most of the economic activities of the people are carried...

RBI imposed Rs 26.60 lakh on The Kalupur Commercial Co-operative Bank, Rs 13.30 lakh on Karad Urban Co-operative Bank, Rs 5 lakh on Janata...

Bank Holiday: This has been done in view of the transactions related to receipts and payments of the Government of India. After this order...

RBI has issued a press release saying that in an order given on March 13, a fine of Rs 63 lakh 60 thousand has...

The restrictions imposed by RBI on Paytm Payments Bank Limited (PPBL) are coming into effect from today i.e. March 16. We are going to...

Bank Of India: The Reserve Bank of India (RBI) on Wednesday said that it has imposed a penalty of Rs 1.4 crore on Bank...

Credit and Debit Rules: The Reserve Bank (RBI) has made some changes in the rules related to credit and debit cards. If you also...

Reserve Bank Governor Shaktikanta Das said that 80-85 percent of users using Paytm wallet will not face any disruption due to regulatory action. Reserve Bank...

RBI New Card Issue Rules: Reserve Bank of India (RBI) has made new guidelines for issuing credit cards by banks and NBFCs. Let us...

Credit Card Issuance Rules: The banking regulator has issued this notification in this regard. According to this notification, the bank has decided to change...

RBI Rules: To keep the security of accounts in banks tight, RBI can tighten KYC rules in collaboration with banks. According to media reports,...

2000 Currency Note Update: Option to exchange currency or deposit the amount in their bank accounts has been given in 19 offices of RBI. 2000...

Savings Account Cash Limit: We keep our hard-earned money in savings account. RBI has made many rules for its security. Many people know about...

Bank License Canceled: The Reserve Bank of India (RBI) said that as per the bank's data, 99.13 per cent of depositors are entitled to...

RBI Rules: A single document has been issued consolidating all the instructions to ensure compliance regarding submission of monitoring data for banks and non-banking...

The effect of RBI removing Rs 2,000 bank note from circulation is beginning to be seen. According to the data, the growth of currency...

The Reserve Bank of India has extended the deadline for implementing the ban on Paytm Payments Bank. Paytm Payments Bank has been given 15...

Paytm Crisis: Reserve Bank of India (RBI) Governor Shaktikanta Das refused to review any action taken against Paytm Payments Bank. New Delhi: Ever since the...

I just wonder if an AGM of RBI authorised to speak on behalf of the apex bank on policy matters and also whether such statements as the one stated to have been made by one AGM is indeed reliable and authentic.