SBI Cheque State Bank of India (SBI) has issued a warning to issuers of Cheque and those making Cheque payments for transactions.

Despite the increase in online transactions, there are still many people who give Cheque for transactions. However, Reserve Bank of India (RBI) introduced positive pay system two years ago due to the high incidence of Cheque frauds. This method is useful to break the frauds in transactions like taking Cheque and giving money, transferring Cheque and clearing Cheque. State Bank of India (SBI) has also been running a positive pay system for a long time. SBI Positive Pay System is a security measure implemented by the bank to prevent Cheque fraud. It is useful for prevention of frauds like Cheque tampering.

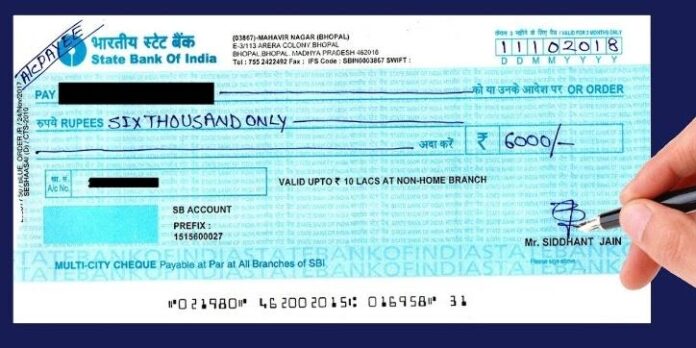

In the Positive Pay system the details of the Cheque have to be re-verified to the bank. These details at the time of processing the Cheque and making the paymentBank Cross Cheque. Positive pay system protects customers from Cheque fraud. SBI Positive pay system consists of two steps. One is account registration and second is lodgement of cheque.

Ensure safe and secure payments with Positive Pay System.

For more information, visit: https://t.co/THJP6t85UX#SBI #PositivePaySystem #AmritMahotsav pic.twitter.com/wMM1dD39BV

— State Bank of India (@TheOfficialSBI) August 2, 2023

Customers who want to use positive pay system have to submit the application in the prescribed format in the bank and do one time registration. internet banking, Mobile Registration can also be done through banking and Yono app. Savings Positive pay system is mandatory for Cheque worth Rs.5 lakhs or more in the case of account, and for Cheque worth Rs.10 lakhs or more in the case of accounts like current account, cash credit, overdraft.

If the customer gives a Cheque to anyone, the details should be disclosed to the bank. Account number, Cheque number, date of Cheque, amount written on the cheque, name of beneficiary and type of instrument should be disclosed to the bank. These details can be disclosed to the bank through internet banking, mobile banking and SMS.

The person to whom you gave the cheque, if you take the Cheque to the bank, the bank will compare all these details before clearing it. The transaction will complete only if all the details are correct. If the details on the Cheque do not match with the details provided by you, the bank will reject the cheque. Return charges are not applicable in such cases.