Fixed deposits have regained some of the luster they had lost during the Covid era amidst the rising interest rates on bank term deposits brought on by the increase in the repo rate

Fixed deposits have regained some of the luster they had lost during the Covid era amidst the rising interest rates on bank term deposits brought on by the increase in the repo rate. Debt investors are rushing to find banks that are offering higher interest rates, and the reason for this is that fixed deposits are one of the safest investments available. They not only provide secure returns, but also enough liquidity for you to prepare for a long-term financial objective. Because fixed deposit interest rates are not impacted by market risk, you receive a fixed income on a quarterly or annual basis. Additionally, your deposits are covered by the DICGC’s insurance up to ₹5 lakhs, bringing an extra cheese round to your supper. Most investors think of the post office or a major bank like SBI when talking about fixed deposits. Therefore, let’s calculate how much one needs to put in a fixed deposit scheme offered by SBI and the post office to receive the ₹10 lakh maturity amount.

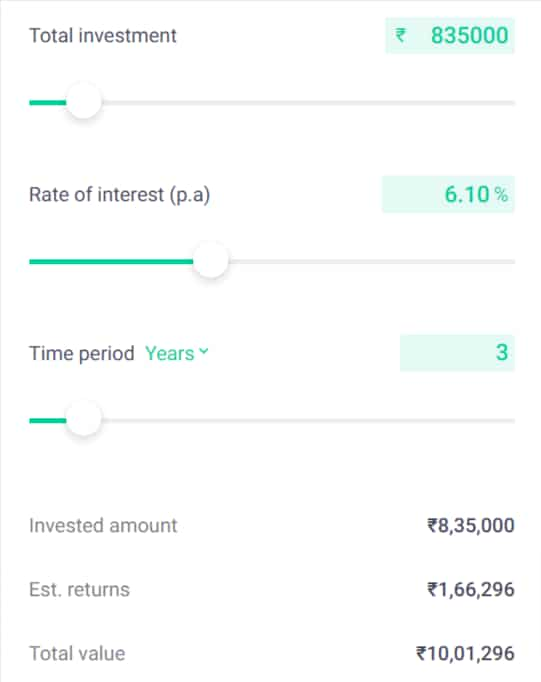

SBI FD Calculator

State Bank of India (SBI) introduced the UTSAV Deposit with advantages such as higher interest on the occasion of 75 years of independence. The period of this special scheme runs from 15.08.2022 to 28.10.2022 and the scheme comes with a tenure of 1000 Days or nearly 3 years approx. For domestic retail term deposits placed under the SBI UTSAV Deposit programme, non-senior citizens will earn an interest rate of 6.10%, and senior citizens would get an interest rate of 6.60%. So, taking into account the duration and interest rate of the UTSAV Deposit plan, an investor would need to make a fixed deposit of Rs. 8.35 lakh for a duration of 3 years at an interest rate of Rs. 6.10% in order to get a maturity value of Rs. 10.01 lakh.

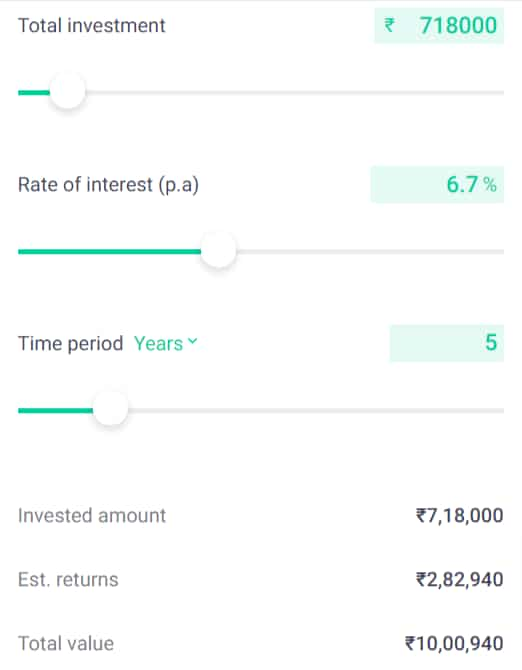

Post Office FD Calculator

Post Office Time Deposit Account (POTD) a small savings scheme offered by India Post is similar to bank deposits and as the name suggests, post office fixed deposits are backed by the Government of India. A minimum deposit of INR 1000 must be made in multiples of 100 to start a post office time deposit account. Deposits can be made for terms of 1, 2, 3, or 5 years. On 1 to 3 years of deposits, POTD is fetching an interest rate of 5.5% whereas deposits maturing in 5 years will fetch an interest rate of 6.7 % payable annually but calculated quarterly.

There is a catch, though, in that POTD does not provide older residents with additional benefits as banks do in terms of interest rates. Section 80C deduction of the Income Tax Act of 1961 is applicable to the investment made under the five-year TD plan. Taking 5.5% interest and tenure of 3 years into consideration one needs to invest ₹8.50 lakh for 3 years in a POTD account to get a maturity amount of ₹10.01 lakh. To get a maturity amount of ₹10 lakh in 5 years, an investor must place a fixed deposit of ₹7.18 lakh in a post office time deposit account, assuming a 6.7% interest rate and a 5-year term.

Note

Depositors at post offices and banks should be aware that TDS at 10% is withheld from your fixed deposit account if the interest generated on a fixed deposit surpasses INR 40,000 for non-senior citizens and INR 50,000 for elderly individuals. A person is subject to TDS if they fall under the category of taxable income. If you have provided your PAN card details, TDS at a rate of 10% will be applied to the interest received on fixed deposits. If your PAN has not been submitted, the TDS rate will be 20%. Only when investors have non-taxable income, they can utilise Forms 15G and 15H to avoid TDS deduction.