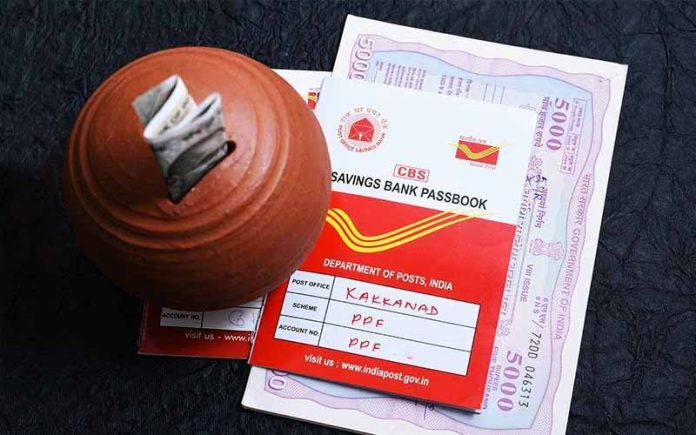

Small Saving Scheme: The government revises the interest rates of small savings scheme every quarter. The government will fix the interest rates of Small Savings Scheme (Post Office Small Saving Scheme) for the July to September 2024 quarter

Small Saving Scheme: The government revises the interest rates of small savings schemes every quarter. The government will fix the interest rates of the Small Savings Scheme (Post Office Small Savings Scheme) for the July to September 2024 quarter. The government did not change the interest rates for the April to June quarter 2024. Now at the end of June, the government can fix the interest rate for the small savings scheme.

These are the small savings schemes

Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), Mahila Samman Savings Certificate, Senior Citizen Savings Scheme (SCSS) and National Savings Certificate (NSC) are some famous small savings schemes among the common people. Here the financiers are telling about the interest being received on the small savings scheme for the first quarter of the year 2024-25.

This is the interest rate on small savings scheme right now

| Number | Saving Scheme | Interest Rate from 01.04.2024 to 30.06.2024 | When do you get interest |

|---|---|---|---|

| 01. | Post Office Savings Account | 4.0 | every year |

| 02. | 1 year FD | 6.9 (Annual interest on ₹10,000/- is ₹708) | Quarterly |

| 03. | 2 year FD | 7.0 (Annual interest for ₹10,000/- is ₹719) | Quarterly |

| 04. | 3 year FD | 7.1 (Annual interest for ₹10,000/- is ₹719) | Quarterly |

| 05. | 5 year FD | 7.5 (Annual interest on ₹10,000/- is ₹771) | Quarterly |

| 06. | 5 Year Recurring Deposit | 6.7 | Quarterly |

| 07. | Senior Citizen Savings Scheme | 8.2 (Quarterly interest ₹205 for ₹10,000/-) | Payments are made quarterly. |

| 08. | Monthly Income Scheme | 7.4 (Monthly interest ₹62 for ₹10,000/-) | Payment is made monthly. |

| 09. | National Savings Certificate (8th Issue) | 7.7 (Maturity Value ₹14,490 for ₹10,000/-) | every year |

| 10. | Public Provident Fund Scheme | 7.1 | every year |

| 11. | Kisan Vikas Patra | 7.5 (will mature in 115 months) | every year |

| 12. | Mahila Samman Saving Scheme | 7.5 (Maturity Value ₹11,602 for ₹10,000/-) | Quarterly |

| 13. | Sukanya Samriddhi Scheme | 8.2 | every year |