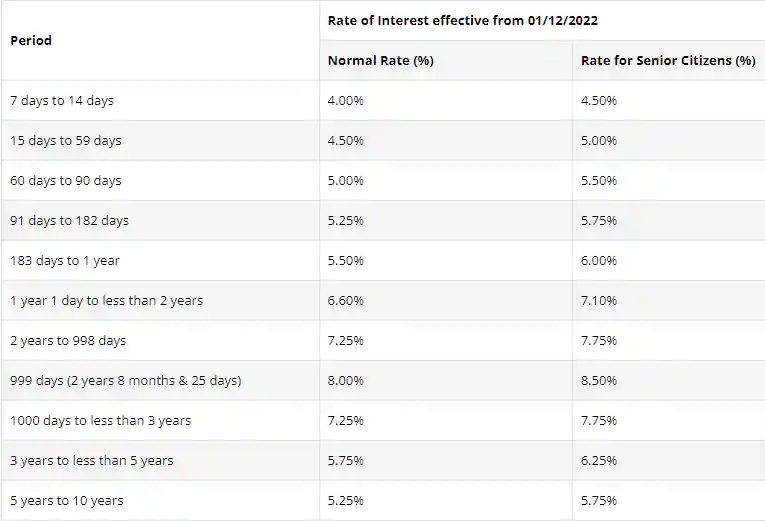

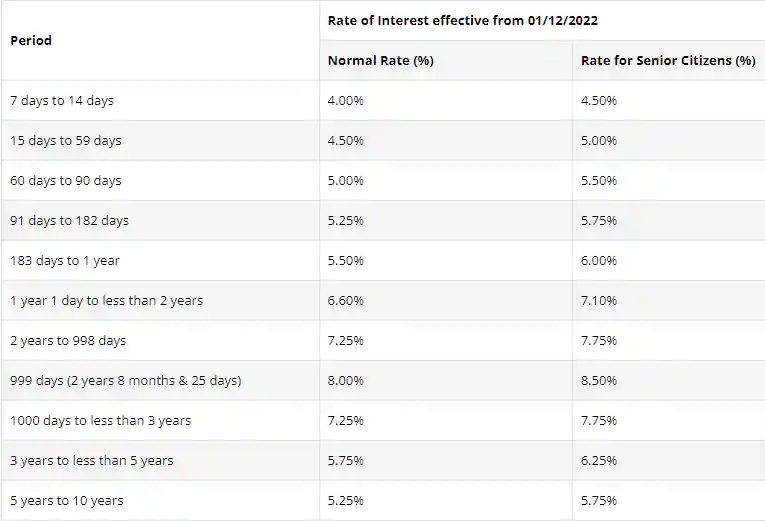

Special FD rate: ESAF Small Finance Bank has revised its interest rates on fixed deposits of less than ₹2 Cr. As per the official website of the bank, the new rates are effective as of today 01/12/2022. Following the revision, the bank is now providing interest rates on deposits maturing in 7 days to 10 years that range from 4.00% to 5.25% for the general public and 4.50% to 5.75% for senior citizens. The maximum interest rate on deposits maturing in 999 days (2 years, 8 months, and 25 days) has adjusted to 8.50% for senior citizens and 8.00% for non-senior citizens.

ESAF Small Finance Bank FD Rates

The bank is currently offering an interest rate of 4.00% on deposits maturing in the next 7 to 14 days, and ESAF SFB is also offering an interest rate of 4.50% on deposits maturing in the next 15 to 59 days. The current interest rates offered by ESAF SFB are 5.00% for FDs maturing in 60 to 90 days and 5.25% for those maturing in 91 to 182 days. Deposits with maturities between 183 days and a year will now earn interest at a rate of 5.50%, while those with maturities between 1 year and a day and less than 2 years will earn interest at a rate of 6.60%.

On deposits maturing in 2 years to 998 days, the bank is offering an interest rate of 7.25% and on those maturing in 999 days (2 years 8 months & 25 days), ESAF SFB is now offering an interest rate of 8.00%. On FDs maturing in 1000 days to less than 3 years, ESAF SFB is currently offering an interest rate of 7.25%, and the bank is guaranteeing an interest rate of 5.75% on those maturing in 3 years to less than 5 years. Deposits maturing in the next five to ten years will now earn interest at a bank rate of 5.25%.

Post today’s interest rate revision, ESAF SFB has discontinued its Special FD rate of 8.00% for 999 days on 30th November 2022. The new interest rates are valid for new resident term deposits as well as renewals of existing resident term deposits; however, no interest will be paid on resident term deposits that are prematurely withdrawn before the lapse of seven days from the date of deposit.

ESAF SFB has also mentioned on its website that “Effective 1st December 2022, we will be charging for non-maintenance of the Monthly Average Balance for all NRE / NRO Savings & Current Account categories. For newly opened NRE / NRO Savings & Current Accounts, an MAB waiver period of 3 months is applicable, post which the charges shall be applicable as per the Schedule of Charges.”