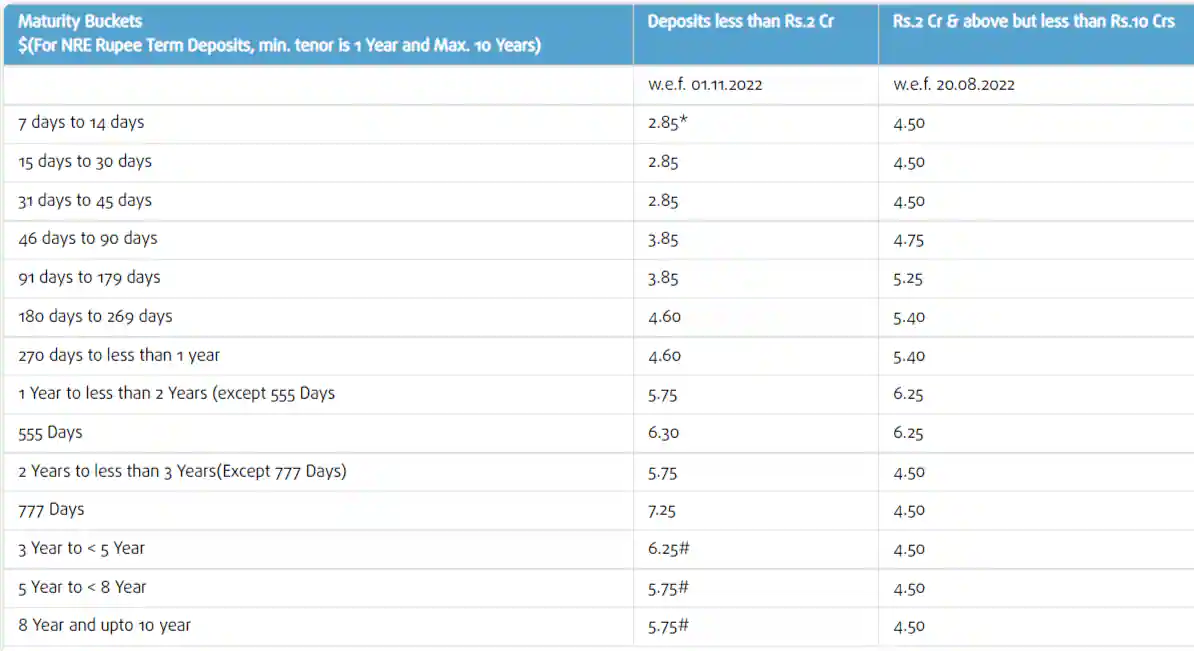

The leading public sector lender Bank of India (BOI) has revised its interest rates on fixed deposits (FDs) of less than ₹2 Cr. As per the official website of the bank, the new rates are effective as of 01.11.2022. Following the change, the bank is now providing an interest rate on deposits with maturities ranging from 7 days to 10 years that range from 2.85% to 5.75%. The bank is now paying the general public an interest rate of 7.25% and senior citizens an interest rate of 7.75% on deposits that mature in 777 days. The “Star Super Triple Seven Fixed Deposit” programme, which BOI announced today is already creating more buzz among fixed deposit investors as the name suggests, the recently introduced Fixed Deposit Scheme allows depositors to earn an interest rate of 7.25% on a deposit for 777 days, and up to 7.75% for elderly persons.

BOI FD Rates

On deposits maturing in 7 days to 45 days, the bank will now offer an interest rate of 2.85% and on those maturing in 46 days to 179 days, BOI will now offer an interest rate of 3.85%. Deposits maturing in 180 days to less than 1 year will now pay an interest rate of 4.60% and those maturing in 1 Year to less than 2 Years (except 555 Days) will pay an interest rate of 5.75%. Bank of India is offering an interest rate of 6.30% on deposits maturing in 555 Days and the bank is offering an interest rate of 5.75% on those maturing in 2 Years to less than 3 Years(Except 777 Days). On deposits maturing in 777 days, BOI will now pay an interest rate of 7.25% and on those maturing in 3 years to 5 years, BOI will now pay an interest rate of 6.25%. Fixed deposits maturing in 5 years to 10 years will now pay an interest rate of 5.75%.

Bank of India has mentioned on its website that “Additional premium of 25 bps, over & above the existing 50 bps will be paid to Senior Citizen’s on their retail TD (Less than Rs. 2 Cr) for all the tenors of 3 Years & above i.e. 75bps.”

While launching its “Star Super Triple Seven Fixed Deposit” scheme today, BOI has said in a release that “When compared to other investment options such as Public Provident Fund, Senior Citizen Savings Scheme, National Savings Certificate, or RBI Bond, Bank of India’s 777-day FD scheme is the most lucrative and a smart investment option.”

The interest rate on the bank’s existing 555-day fixed deposit programme has been hiked to 6.30% in addition to this new offering. The bank increased the rate by 25 basis points for additional time buckets between 180 days and less than 5 years.

Read Also: Income Tax Return: Big News! Last date to file ITR extended, now you can file income tax return till this date