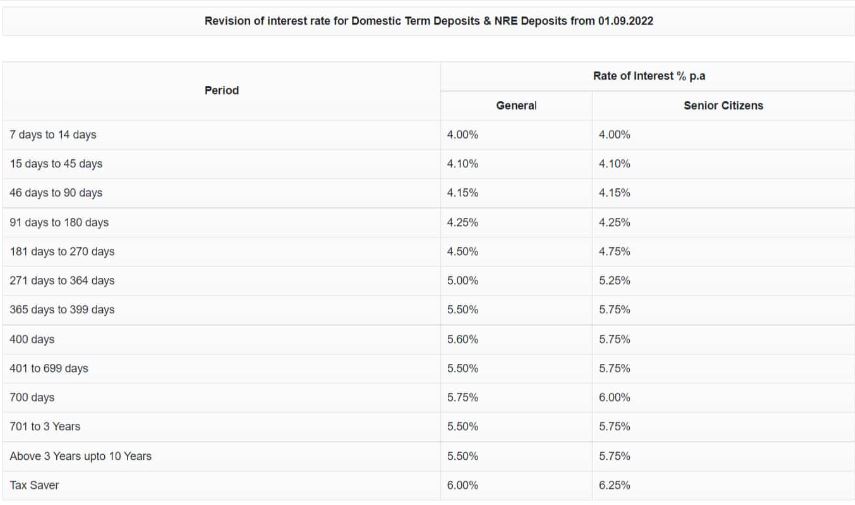

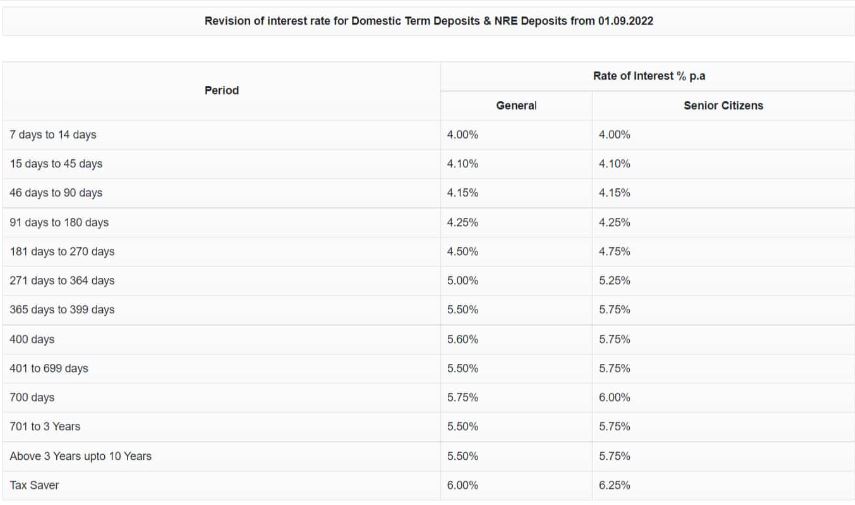

City Union Bank, a private sector lender, modifies the interest rates on fixed deposits under ₹2 crore. The new rates are effective as of September 1, 2022, and they are applicable to domestic term deposits, according to the bank’s official website. After the adjustment, the bank is now guaranteeing an interest rate on fixed deposits with maturities ranging from 7 days to 10 years between 4.00% and 6.00% for the general public and 4.00% to 6.25% for senior citizens.

City Union Bank FD Rates

The bank is currently offering an interest rate of 4.00% on fixed deposits with maturities between 7 and 14 days, and 4.10% on term deposits with maturities between 15 and 45 days. Fixed deposits with maturities between 46 and 90 days will now earn interest at a rate of 4.15%, while term deposits with maturities between 91 and 180 days will now pay interest at a rate of 4.25%. Fixed deposits maturing from 181 days to 270 days will now earn interest at a rate of 4.50%, while term deposits maturing from 271 days to 364 days will earn interest at a rate of 5.00%.

On fixed deposits maturing in 365 days to 399 days, City Union Bank is now offering an interest rate of 5.50%, while the bank will also guarantee an interest rate of 5.60% on fixed deposits maturing in 400 days. The bank will now guarantee an interest rate of 5.50% on fixed deposits maturing in 401 to 699 days, and an interest rate of 5.75% on term deposits maturing in 700 days. The bank is currently giving an interest rate of 5.50% on term deposits maturing in 701 to 10 years and 6.00% on tax-saving fixed deposits with a maturity term of 5 years.

City Union Bank has mentioned on its website that “For NRO deposits, the above rates under General category will alone be applicable i.e., senior citizen rate is not applicable.”

On the other hand, the private sector lender RBL Bank announced an interest rate hike on savings accounts. As per the official website of the bank, the new rates will be in force from 5th September. The RBL Bank, one of the private sector banks, is now giving a maximum interest rate of 6.25% on savings account deposits of above ₹25 lakh and up to ₹7.5 crore.