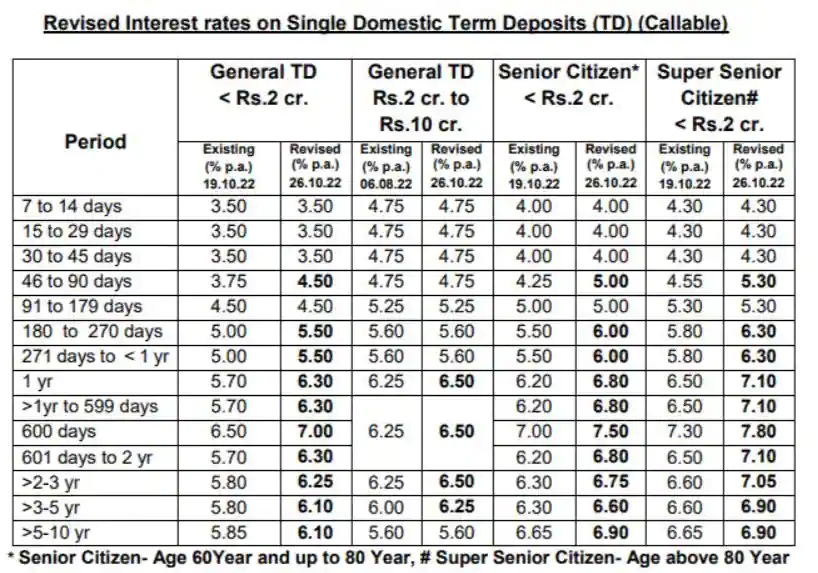

Punjab National Bank hiked interest rates: The leading public sector lender Punjab National Bank has hiked interest rates by up to 75 bps on fixed deposits of less than ₹2 Cr. As per the official website of the bank the new rates are effective as of today 26th October 2022. Following the revision, the bank is now offering interest rates ranging from 3.50% to 6.10% on deposits maturing in 7 days to 10 years. Punjab National Bank will now offer a maximum interest rate of 7% to the general public, 7.50% to senior citizens and 7.80% to super senior citizens on deposits maturing in 600 days.

PNB FD Rates

On deposits maturing in 46 to 90 days, the bank has hiked the interest rate by 75 bps from 3.75% to 4.50% and on those maturing in 180 to less than 1 year, PNB has hiked the interest rate by 50 bps from 5% to 5.50%. Punjab National Bank (PNB) has hiked the interest rate by 60 bps from 5.70% to 6.30% on deposits maturing in 1 year to 599 days the bank has hiked the interest rate by 50 bps from 6.50% to 7% on deposits maturing in 600 days. Deposits maturing in 601 days to 2 years will now fetch an interest rate of 6.30% which was earlier 5.70% a hike of 60 bps. PNB has hiked interest rates by 45 bps from 5.80% to 6.25% on deposits maturing in 2 to 3 years and has hiked interest rates by 30 bps from 5.80% to 6.10% on deposits maturing in 3 to 5 years. On fixed deposits maturing in 5 to 10 years, the bank has hiked the interest rate by 25 bps from 5.85% to 6.10% on deposits maturing in 5 to 10 years.

PNB NRO, NRE FD Rates

The interest rate on single NRO and NRE term deposits has been raised at PNB. The following are the most recent amended rates.

PNB Tax Saver FD

On tax-saver fixed deposits of 5 years to 10 years, the bank is now offering an interest rate of 6.10% to the general public, 6.60% to senior citizens, and 7.10% for staff members and retired senior citizens.

On domestic deposits of less than Rs. 2 crores, senior citizens 60 years of age and over (up to 80 years of age) would get an additional rate of interest of 50 basis points (bps) over the regular card rates for a term up to 5 years and 80 bps for a period above 5 years. The maximum rate of interest that can be charged over the effective card rate for existing employees and retired employees who are also senior citizens shall be 150 bps for a period up to 5 years and 180 bps for a period above 5 years.

Additionally, super senior citizens who are over 80 years old will get an additional rate of interest that is 80 basis points higher than the respective card rate for all tenors. The highest rate of interest that can be imposed above the relevant card rate for employees and retired employees who are also Super Senior Citizens is 180 bps over the applicable card rate for all tenors. The highest rate of interest over the appropriate card rate for PNB Tax Saver Fixed Deposit Scheme employees and retired employees who are Senior Citizens is 100 bps.

Read Also: HDFC Bank hikes fixed deposit interest rates, second time this month, See here new rates