Even after maturity, if you wish, you can extend this scheme once for another three years. You can start investing with as little as Rs 1000. Currently 8.2 percent annual interest rate is being offered in the scheme.

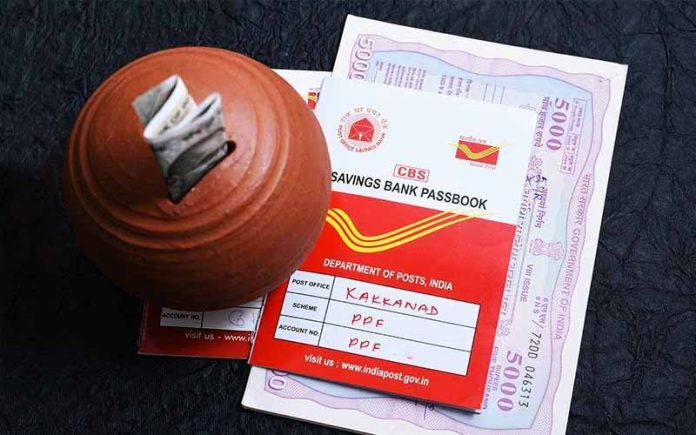

Post office scheme: One of the post office saving schemes is very special for senior citizens. Yes, this is Post Office Senior Citizen Saving Scheme. All people above 60 years of age can invest in this. On the one hand, it gives higher returns and on the other hand, tax exemption of up to Rs 1.5 lakh can be availed on the money deposited in it. Even after maturity, if you wish, you can extend this scheme once for another three years.

Who can open an account

Any person above 60 years of age can open an account. According to the official website of India Post, the account can be opened only in individual capacity or jointly with spouse. Keep in mind here, the entire amount deposited in the joint account will be due only to the first account holder. In this, those retired people in the age group of 55-60 years who have opted for Voluntary Retirement Scheme (VRS) can also open an account. Not only this, retired defense personnel above 50 years of age and below 60 years can also open an account if they invest within three days of receiving retirement benefits.

Investment limits and tax exemptions

You can start investing in Post Office Senior Citizen Saving Scheme with a minimum of Rs 1000. You can invest in this in multiples of Rs 1000. Yes, in this scheme you can deposit up to Rs 30 lakh in all the accounts opened by you. If you deposit more than this, that amount will be returned to you immediately. Investments under this scheme are eligible for the benefits of Section 80C of the Income Tax Act, 1961. That means you can avail tax exemption.

Interest rate or return

Currently, 8.2 percent annual interest rate is being offered in the Post Office Senior Citizen Saving Scheme. Interest is payable on quarterly basis and is applicable from the date of deposit till 31st March/30th June/30th September/31st December. If the interest payable quarterly is not claimed by the account holder, no additional interest is available on such interest. Interest can be withdrawn through auto credit into the savings account in the same post office or ECS. One more thing, if the total interest in all SCSS accounts exceeds Rs 50,000 in a financial year then the interest is taxable and TDS is deducted at the prescribed rate from the total interest paid. Yes, if Form 15G/15H is submitted and the interest earned does not exceed the prescribed limit then no TDS is deducted.

When can the account be closed

Post Office Senior Citizen Saving Scheme account can be closed after five years from the date of account opening by submitting the prescribed application form along with the passbook. Additionally, if the account holder dies, the account will earn interest at the Post Office Savings Account rate from the date of death. If the spouse is a joint holder or sole nominee, the account can be continued till maturity, if the spouse is eligible to open a SCSS account and does not have any other SCSS account.